In the world of online trading, the allure of high returns often leads investors to brokers that promise more than they can deliver. One such entity is EXFOR, a broker operating under the domain exfor.com. While it presents itself as a legitimate trading platform, a closer examination reveals numerous red flags that suggest it may be engaging in fraudulent activities. This article aims to shed light on the deceptive practices of EXFOR, providing potential investors with the information needed to protect their funds.

Information About the Fraudulent Broker: A Detailed Review

EXFOR, operating through the website exfor.com, claims to offer a range of trading services, including forex, stocks, commodities, cryptocurrencies, bonds, and indices. The broker asserts that it operates under the company name Exfor Limited, based in Malaysia’s Labuan Special Economic Zone. However, discrepancies in its regulatory claims raise significant concerns.

The website states that EXFOR is authorized and regulated by the Labuan Financial Services Authority (Labuan FSA). However, independent reviews and databases indicate that EXFOR is not listed in the Labuan FSA’s records, casting doubt on its regulatory status.

Furthermore, EXFOR’s trading conditions, such as a minimum deposit requirement of $100 and leverage of 1:100, may appear attractive to new traders. However, these terms are standard in the industry and do not compensate for the lack of regulatory oversight and transparency.

Verification of Company Data: Unreliable and Inconsistent Information

The legitimacy of a broker can often be assessed by examining the consistency and reliability of the information it provides. In the case of EXFOR, several inconsistencies and unverifiable claims raise questions about its authenticity.

While EXFOR claims to be regulated by the Labuan FSA, independent sources have found no record of the company in the Labuan FSA’s database. This discrepancy suggests that EXFOR may be misrepresenting its regulatory status to appear more credible to potential investors.

Additionally, the broker’s contact information is limited to an email address ([email protected]) and a phone number (+60 87 416 989). The absence of a physical office address or detailed company background further contributes to the lack of transparency surrounding EXFOR’s operations.

Exposing the Broker as a Fraudster: Identifying Signs of Deception

Several warning signs indicate that EXFOR may be engaging in fraudulent activities:

- Unregulated Status: As previously mentioned, EXFOR’s lack of regulation by a reputable financial authority is a significant red flag.

- Withdrawal Issues: Reports from users indicate difficulties in withdrawing funds. For instance, a client from Indonesia reported that a withdrawal request was pending for over a month, with customer service providing vague responses.

- Misleading Claims: EXFOR’s website claims to offer services under multiple regulatory bodies, but these assertions lack verifiable evidence, suggesting potential misrepresentation.

- Lack of Transparency: The broker does not provide clear information about its payment methods, transaction fees, or the identity of its liquidity providers, making it challenging for traders to assess the platform’s reliability.

Fraud Broker’s Deception Scheme: How EXFOR Lures and Traps Traders

EXFOR employs several tactics to attract and deceive traders:

- Attractive Offers: The broker entices potential clients with promises of high returns and low initial deposits, creating an illusion of a lucrative trading opportunity.

- Manipulated Trading Conditions: Once traders deposit funds, EXFOR may manipulate trading conditions, such as spreads and slippage, to disadvantage clients and increase the likelihood of losses.

- Withdrawal Restrictions: After accumulating profits, traders often face challenges when attempting to withdraw their funds. EXFOR may delay or deny withdrawal requests, citing various reasons without providing clear explanations.

- Lack of Accountability: The broker’s unregulated status and limited contact information make it difficult for traders to hold EXFOR accountable for any issues or disputes that arise.

How to Get Money Back from a Scam Broker: Assistance from Stop-Scam Specialists

If you have fallen victim to EXFOR’s deceptive practices, recovering your funds can be challenging but not impossible. Here’s how Stop-Scam specialists can assist you:

- Consultation: Stop-Scam offers free consultations to assess your situation and determine the best course of action.

- Investigation: Specialists can trace the flow of your funds, identifying the methods used by EXFOR to withdraw or transfer your money.

- Legal Action: If necessary, Stop-Scam can assist in initiating legal proceedings against EXFOR, leveraging international laws to recover your funds.

- Negotiation: In some cases, specialists can negotiate directly with the broker to facilitate the return of your funds.

It’s crucial to act promptly, as delays can complicate the recovery process.

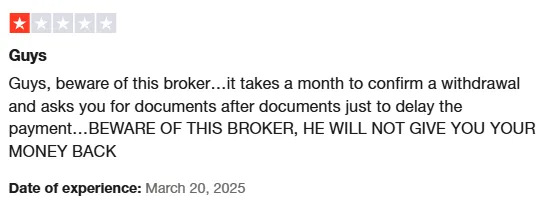

Negative Reviews About the Broker: Accounts from Affected Clients

Numerous traders have shared their negative experiences with EXFOR:

- Delayed Withdrawals: Clients have reported significant delays in processing withdrawal requests, with some funds remaining inaccessible for extended periods.

- Unresponsive Customer Service: Traders have expressed frustration over EXFOR’s customer service, citing unhelpful and generic responses to their concerns.

- Misleading Information: Some clients feel misled by EXFOR’s marketing materials, which promised certain features or returns that were not delivered upon opening an account.

These accounts highlight the challenges faced by traders dealing with EXFOR and underscore the importance of exercising caution when choosing a broker.

The Dangers of Trading with Unregulated Brokers: Understanding the Risks

Trading with unregulated brokers like EXFOR exposes investors to several risks:

- Lack of Investor Protection: Without regulation, there is no oversight to ensure that the broker adheres to fair practices or protects client funds.

- Increased Risk of Fraud: Unregulated brokers are not held to the same standards as regulated entities, making it easier for them to engage in fraudulent activities without facing consequences.

- Difficulty in Dispute Resolution: If issues arise, traders have limited recourse to resolve disputes, as unregulated brokers often operate outside the jurisdiction of financial authorities.

- Potential for Total Loss: In extreme cases, unregulated brokers may disappear with clients’ funds, leaving investors with no means of recovery.

It’s essential to thoroughly research and choose brokers that are regulated by reputable financial authorities to mitigate these risks.

The Result: Protecting Yourself from Broker Scams

The story of EXFOR is not unique in the modern financial landscape. As technology has made trading more accessible, it has also created opportunities for fraudulent brokers to take advantage of unsuspecting investors. EXFOR’s professional-looking website, promises of low commissions, and claims of regulation are all part of a well-crafted illusion aimed at building false trust. However, as we’ve uncovered through deeper investigation and numerous victim testimonials, this broker displays classic signs of fraud.

From unverifiable licenses to misleading marketing strategies, EXFOR has proven itself to be a broker that prioritizes deception over service. Investors lured in by promises of financial growth find themselves trapped in a web of manipulation—unable to withdraw their funds, pressured into making more deposits, and ultimately ghosted once they demand accountability.

One of the most dangerous aspects of scam brokers like EXFOR is how legitimate they appear at first glance. Many victims report being persuaded by customer service agents, seeing what appear to be real trades, and even receiving small initial withdrawals—only to be later denied access to their accounts or told that more payments are required to release their funds. This is a common strategy used by fraudsters to build trust before executing the final stage of the scam.

So how can you protect yourself?

The first step is always research. Before depositing money with any broker, verify their license with reputable financial authorities like the FCA (UK), CySEC (Cyprus), ASIC (Australia), or similar. If a broker claims to be regulated but you can’t find them listed in official registries, it’s a major red flag.

Secondly, rely on community experiences. Websites like Trustpilot, Forex Peace Army, and Reddit often contain valuable insights from real users. In the case of EXFOR, these platforms are full of negative reviews describing similar patterns of deception, poor customer service, and outright theft.

If you’ve already fallen victim to EXFOR or a similar broker, know that all is not lost. Recovery is possible—but it must be handled carefully. Chargeback processes, complaints to regulatory bodies, and legal action require strategic expertise. This is where Stop-Scam steps in.

How Stop-Scam Can Help

Stop-Scam is a dedicated team of legal and financial recovery professionals who specialize in helping victims of fraudulent brokers get their money back. They understand how these scams operate, what tactics to use to recover funds, and how to deal with offshore companies like EXFOR that try to hide behind fake addresses and false corporate identities.

Stop-Scam offers:

- Free consultations to assess your case and determine the best recovery strategy.

- Expert support in collecting documentation, building a case, and working with banks or credit card providers.

- Legal representation if necessary to escalate your claim through international or local legal systems.

- Continuous updates and transparency so you always know what’s happening with your case.

If you believe you’ve been defrauded by EXFOR or any other scam broker, don’t delay. The faster you act, the better the chances of recovery.

I got lured into Exfor by someone claiming to be a financial advisor. They walked me through the whole process, helped me make the initial deposit, and even showed me fake profits on their platform. Once I deposited a larger amount, they vanished. Their customer support stopped replying, and I was locked out of my account. I’m currently looking for assistance and wondering what legal options exist to deal with offshore brokers like this.

Leave a request and our specialists will help you.

Thanks for putting together this detailed review. I wish I had found it earlier. My experience with Exfor was almost identical to what’s described here – fake trades, pressure to deposit more, and no way to withdraw. I’ve already reported them to the relevant financial authorities, but so far, no action. Is it worth hiring a recovery service in such cases? Has anyone had success?

We will be happy to help you, leave a request on the website.

They took over $10,000 from me and made it look like I was earning profits, only to block my account when I asked for a withdrawal. I’ve since been in touch with a legal team that specializes in recovering funds from scams. While the process is not cheap and takes time, I’m slowly starting to see progress. I urge anyone else scammed by Exfor to keep a record of everything—emails, receipts, chats—because it will help later.

Leave a request and we will help you.

What really shocks me is how professional these scammers can appear. Exfor had a slick website, convincing brokers, and what looked like real trading activity. I was skeptical at first, but they managed to gain my trust over weeks of communication. Now I know it was all fake. I’m trying to gather all my documentation to begin a recovery case. If anyone’s been through this already, I’d appreciate any tips on how to start.

Specialists will contact you after you leave a request on the website.

I’m currently in the middle of trying to recover funds from Exfor. The hardest part was admitting I had been scammed, especially after ignoring the warning signs. They played on emotions, promised consistent returns, and used very manipulative tactics. It’s frustrating how unregulated some of these brokers are. If anyone is thinking of investing with them—don’t. And if you already have, seek help immediately.

Our team will help you get your stolen money back, leave a request.