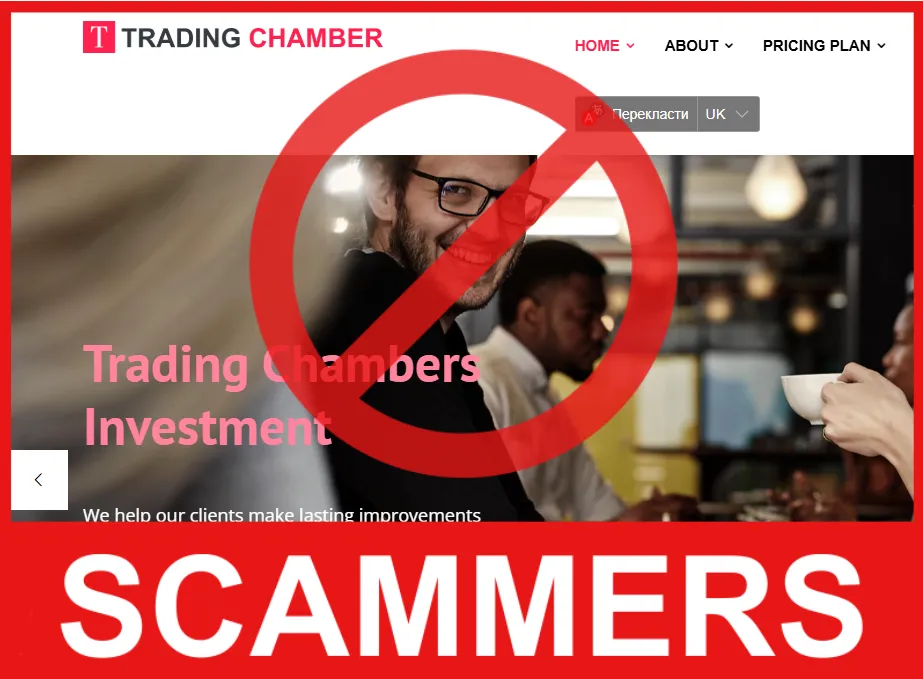

Investors face numerous challenges in the world of online trading, with one of the most alarming being the rise of fraudulent brokers. One such dubious entity is Trading Chambers, a platform that presents itself as a secure investment company offering high returns and professional services. However, behind the slick facade lies a complex scam designed to lure unsuspecting investors into financial ruin. This article will delve into the details of Trading Chambers, its deceptive practices, and how victims can seek to recover their lost funds with the help of Stop-Scam specialists.

Information About the Fraudulent Broker: A Detailed Review

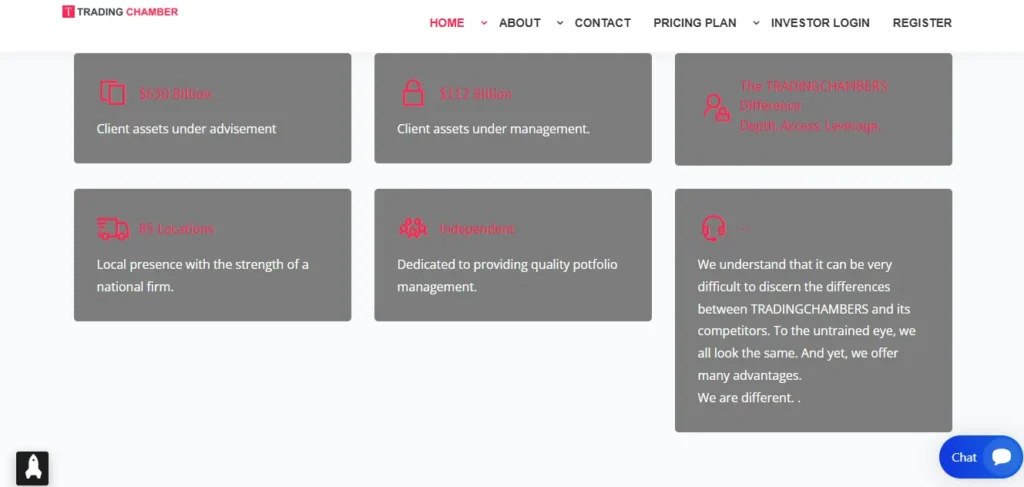

Trading Chambers markets itself as a professional investment platform with claims of offering high returns from diverse investment plans, including cryptocurrency and traditional financial markets. Their website boasts impressive figures—stating billions in assets under management, promising high yields, and guaranteeing secure withdrawals. However, such claims are typical of fraudulent brokers, whose goal is to gain trust through exaggeration and false promises.

Investors are often attracted by the large commissions, “guaranteed” returns, and the enticing use of cryptocurrency payments, which allow for easier money transfers while maintaining a degree of anonymity. These tactics, though seemingly convincing, are common red flags that point towards scam operations. The truth is that Trading Chambers has not provided verifiable proof of its legitimacy. The absence of regulatory oversight or any license from recognized financial authorities like the SEC or FCA further deepens suspicions about its true intentions.

Verification of Company Data: Unveiling the Lies

Despite claiming to operate in a legitimate manner, Trading Chambers fails to provide substantial evidence of its authenticity. One of the main points of concern is the lack of regulatory accreditation. The website claims the company operates legally, yet no concrete proof of registration with official bodies like the SEC, FCA, or other reputable authorities is visible. Many fraudsters fabricate such claims to present a facade of trustworthiness.

The address listed on their website, “785 Toyota Rd #2, Totowa, NJ 07512, United States,” offers no verifiable connection to any registered business. A quick search into this address reveals no records of a legitimate company associated with it, adding another layer of deception.

Exposing the Broker as a Fraudster: Recognizing the Signs of Deceptive Practices

Trading Chambers employs numerous classic scam tactics to trick its investors. The most significant of these is the promise of consistently high returns, which in reality is unsustainable. No legitimate financial institution can guarantee high profits without risk, but fraudulent brokers often lure victims by offering seemingly risk-free investments with unbelievable returns.

Another tactic involves the use of complex bonus schemes and referral programs. These schemes are designed to encourage continued investment, often trapping clients into a cycle where they are incentivized to recruit others into the platform, furthering the broker’s fraudulent activities. Victims often report being unable to withdraw their funds, or facing delayed or denied withdrawal requests, even after fulfilling the platform’s conditions.

The Fraud Broker’s Deception Scheme: How They Trap Investors

The scam operates with a well-coordinated scheme. Initially, the broker offers attractive sign-up bonuses, such as a $20 registration gift or lucrative referral commissions. Once an investor signs up and deposits money, they are encouraged to participate in increasingly larger investments with the promise of compound interest. The broker will then begin to make it more difficult for the victim to access their funds. In many cases, the money is either withheld for long periods or lost entirely due to the broker’s fraudulent activities.

This manipulation is designed to keep investors hooked, believing they are accumulating wealth when, in fact, they are only contributing to the scammer’s profits.

How to Recover Money from a Scam Broker: Stop-Scam Experts Can Help

If you’ve fallen victim to Trading Chambers or another fraudulent broker, it’s crucial to act swiftly. Recovering lost funds can be challenging, but specialists like Stop-Scam offer expert services in tracing funds and facilitating legal actions to reclaim your investment. By engaging with Stop-Scam, you gain access to experienced professionals who understand the intricacies of dealing with fraud, from contacting financial institutions to filing complaints with regulatory authorities.

Stop-Scam’s team helps track down money that was illicitly transferred or stolen by providing essential evidence to authorities and other legal channels. They offer a systematic approach to initiate chargebacks or initiate legal processes for compensation, ensuring that the fraudsters face consequences for their actions.

Negative Reviews About Trading Chambers: What Victims Are Saying

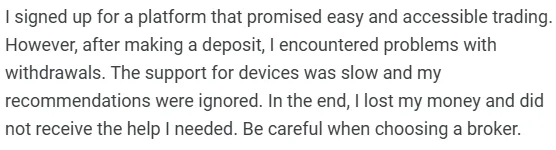

The negative reviews from investors paint a grim picture of Trading Chambers. Many users report being unable to withdraw their funds or facing excessive delays. Others mention that after investing, they were locked out of their accounts or received fraudulent “advice” on how to “maximize” their returns, which only resulted in further losses.

A common theme among affected clients is that once the initial investment was made, the broker stopped responding to requests for withdrawals, citing “technical difficulties” or providing false assurances. The platform’s unprofessional handling of customer complaints and its refusal to resolve issues further highlight its deceptive nature.

Beware of Cryptocurrency Investment Schemes

While cryptocurrency can be a legitimate and profitable investment, it is also commonly exploited by fraudulent brokers like Trading Chambers. The anonymity provided by cryptocurrencies offers scammers an easy way to collect payments without being traced. If a broker solely deals in cryptocurrency without providing proper regulation or oversight, it’s a significant warning sign. Always ensure that any investment in crypto is backed by proper security measures and regulation to avoid falling victim to scams.

The Result: Why Contact Stop-Scam Specialists Immediately

The rise of fraudulent brokers like Trading Chambers is a growing concern for investors worldwide. Understanding the signs of a scam and acting promptly is crucial to minimizing financial loss. With the expertise of Stop-Scam specialists, victims of Trading Chambers and similar fraudsters can take legal action to recover their funds. Stop-Scam’s knowledgeable team is dedicated to providing clients with the best possible chance of reclaiming their lost investments and holding fraudulent brokers accountable.

If you or someone you know has been targeted by a scam broker, don’t hesitate to reach out to Stop-Scam. Their professional support and proactive approach can make all the difference in your efforts to recover your money and seek justice.

Trading Chambers promised me guaranteed returns and showed me fake profits through their fake dashboard. I eventually invested more and more, thinking I was making progress. It wasn’t until I tried to withdraw that I realized I had been scammed. I reached out for legal advice and was told that these scams often involve networks of fake brokers. I’m now trying to collect all the evidence, emails, and payment details. If anyone’s had success with recovery, please let me know.

Leave a request and our specialists will help you.

Unfortunately, I was tricked by Trading Chambers last year. I invested a significant portion of my savings after months of convincing by their fake brokers. The withdrawals were always delayed or declined with excuses. I’ve since reported the case to financial authorities and started a recovery process with legal assistance. It’s been slow, but at least I feel like something is being done. Just a warning to others: these scammers are very convincing and professional on the surface.

We will be happy to help you, leave a request on the website.

I’m in the early stages of trying to recover funds from Trading Chambers. I was scammed out of $3,500 through what seemed like a legit investment platform. They used aggressive tactics, constant calls, and even manipulated trading data to make it seem like I was profiting. I’ve reported them, but I’m unsure about the next steps. Has anyone here gone through a similar experience and managed to get their money back? What should I prioritize when building a case?

Leave a request and we will help you.

I actually managed to recover a portion of my funds from Trading Chambers with professional help. It wasn’t easy, and I still lost more than I got back, but it’s better than nothing. If you’ve been scammed, don’t waste time. Keep records of everything—emails, payments, chats. The more evidence you have, the better your chances. These scammers are highly organized, and you’ll need someone who knows how to deal with them. Stay skeptical, even of those offering help.

Specialists will contact you after you leave a request on the website.

Is there any ongoing legal action or investigation against Trading Chambers? I lost over $10,000 and have been struggling to get help. They vanished with my money and cut off all communication. I’ve seen others report similar stories. If enough people speak out, maybe authorities will act. I’d be willing to join a group claim or share my documentation if it helps build a stronger case. Let me know if something like that is already in motion.

Our team will help you get your stolen money back, leave a request.