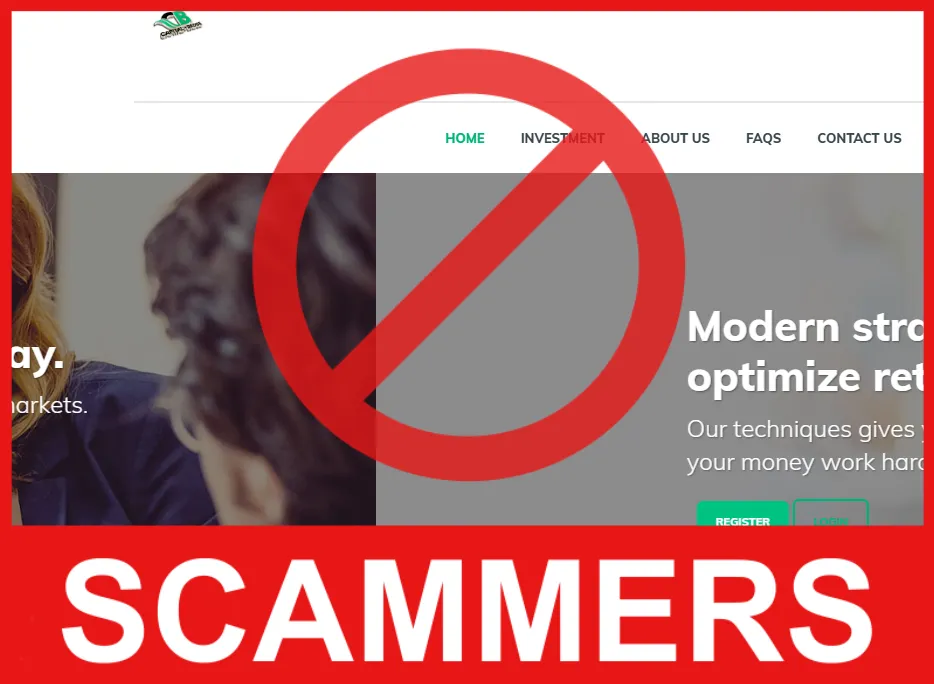

In the ever-evolving world of online trading, investors must remain vigilant against fraudulent schemes that exploit trust and promise substantial returns. One such entity that has come under scrutiny is Capitals Badge, operating through the website https://capitals-badge.org. Despite presenting itself as a legitimate investment platform, various indicators suggest that Capitals Badge is a sophisticated scam designed to deceive and defraud unsuspecting investors.

Information About the Fraudulent Broker: Capitals Badge

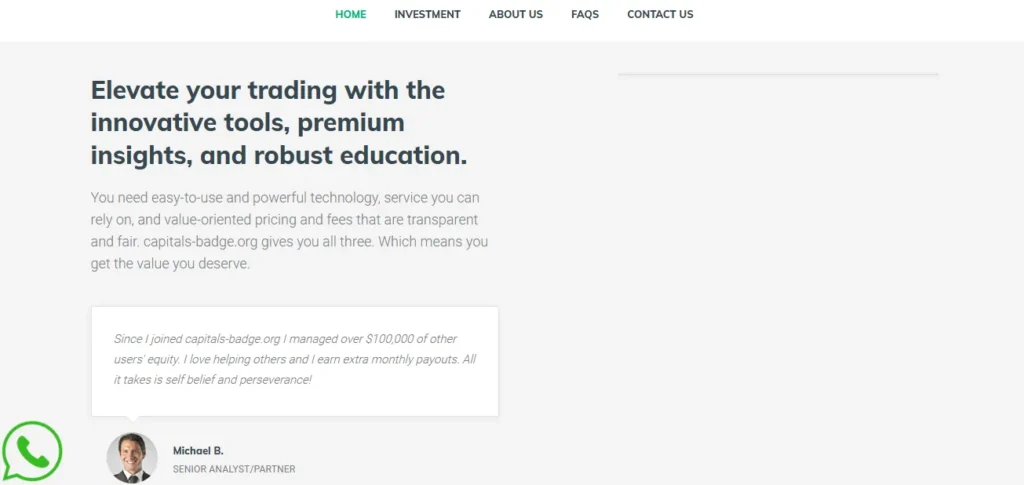

Capitals Badge markets itself as a global investment firm with over six years of experience, claiming to be the fourth-largest stock exchange-listed CFD broker worldwide. The website boasts of having offices in 13 countries, including the UK, Poland, Germany, France, and Turkey, and asserts regulation by top-tier authorities such as the FCA, KNF, and CMB .

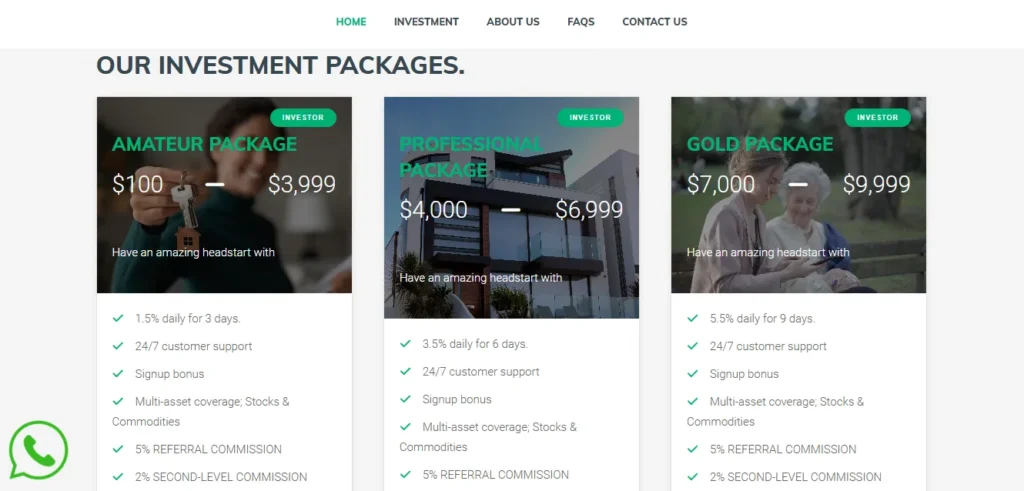

The platform offers various investment packages, ranging from $100 to $15,000, promising daily returns between 1.5% to 10% over periods from 3 days to 3 months. Additionally, they entice users with referral commissions and bonuses, creating an illusion of a lucrative opportunity.

However, upon closer examination, several red flags emerge. The website’s trust score is alarmingly low, with indicators such as the use of WHOIS privacy services to conceal ownership, a recent domain registration, and a high number of suspicious websites hosted on the same server . These factors strongly suggest that Capitals Badge is not a legitimate investment platform but a fraudulent operation aimed at exploiting investors.

Verification of Company Data: Scrutinizing the Claims

Despite the bold claims made on its website, Capitals Badge lacks verifiable evidence to support its assertions. The promised regulation by esteemed authorities like the FCA, KNF, and CMB cannot be corroborated through official channels. A search through the FCA’s Financial Services Register, for instance, yields no results for Capitals Badge or its associated entities.

Moreover, the absence of verifiable information about the company’s leadership, physical office locations, and regulatory licenses further undermines its credibility. Legitimate financial institutions are transparent about their operations and regulatory status; the opacity surrounding Capitals Badge is a significant cause for concern.

Exposing the Broker as a Fraudster: Identifying the Signs

Several characteristics are indicative of a fraudulent broker, and Capitals Badge exhibits many of these traits:

- Unrealistic Promises: Offering daily returns of up to 10% is a classic hallmark of Ponzi schemes.

- Lack of Regulation: Operating without legitimate regulatory oversight leaves investors unprotected.

- Concealed Ownership: Using WHOIS privacy services to hide the identity of the website owner raises suspicions about the company’s legitimacy.

- Suspicious Website Behavior: Indicators such as a low trust score, recent domain registration, and association with other suspicious websites point to a high likelihood of the site being a scam .

These signs collectively paint a picture of a fraudulent entity designed to deceive and defraud investors.

Fraud Broker’s Deception Scheme: How They Operate

The modus operandi of Capitals Badge revolves around enticing investors with promises of high returns and then creating obstacles to prevent withdrawals. Victims report that after making substantial investments and accruing significant earnings, they are informed that they must pay additional fees, such as taxes or processing charges, before they can access their funds. These tactics are designed to delay or completely obstruct the withdrawal process, trapping investors’ money within the platform.

Furthermore, the use of fake testimonials and fabricated success stories on the website serves to build trust and lure in more victims. Once an individual has invested, the focus shifts to preventing them from withdrawing their funds through various fabricated excuses and fabricated fees.

How to Get Money Back from a Scam Broker: Seeking Assistance

If you have fallen victim to Capitals Badge, it is crucial to act swiftly to recover your funds. One effective avenue is to seek assistance from specialized firms like Stop-Scam, which specialize in helping individuals reclaim money lost to fraudulent brokers.

The process typically involves:

- Documentation Gathering: Collect all correspondence, transaction records, and any other relevant information related to your dealings with Capitals Badge.

- Legal Consultation: Consult with legal experts who specialize in financial fraud to understand your options and the best course of action.

- Filing Complaints: Lodge complaints with relevant financial regulatory authorities and consumer protection agencies.

- Pursuing Legal Action: In some cases, pursuing legal action may be necessary to recover your funds.

Stop-Scam’s expertise and experience in dealing with such cases can significantly increase the chances of recovering lost investments.

Negative Reviews About the Broker: Voices of the Victims

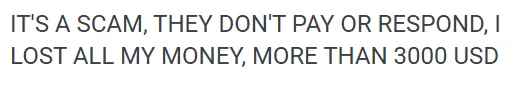

Numerous individuals have shared their negative experiences with Capitals Badge, highlighting the platform’s deceptive practices. For instance, one investor reported being promised a €200 bonus upon depositing €200, which led them to invest a total of €7,050. However, when attempting to withdraw their earnings, they were informed that they needed to pay a €2,500 income tax fee before they could access their funds. Despite assurances, the promised withdrawal never materialized .

These accounts are consistent with the tactics employed by fraudulent brokers, where initial promises and bonuses are used to lure investors, only to be followed by fabricated fees and obstacles that prevent withdrawals.

Recognizing Red Flags: Protecting Yourself from Fraudulent Brokers

In a digital age filled with promises of quick wealth and easy investing, it’s more important than ever to stay vigilant when it comes to choosing a broker. Fraudulent platforms like Capitals Badge are becoming increasingly sophisticated in how they present themselves, often mimicking the appearance and language of legitimate financial institutions. Understanding the red flags and knowing what to look for can protect you and others from devastating financial loss. Below are the most common warning signs and practical tips to help you avoid falling into the trap of a scam broker.

1. Unrealistic Promises and Guaranteed Returns

A legitimate broker will never promise guaranteed returns—especially daily returns as high as 10%, like Capitals Badge claims. The financial markets are inherently risky, and no one can guarantee profits without taking on equal or greater risk. If a broker is advertising a “guaranteed income,” that should immediately raise suspicion.

2. Lack of Regulation and Verification

Before you open an account with any broker, it’s crucial to verify whether they are licensed and regulated by a recognized authority (such as the FCA in the UK, ASIC in Australia, or the SEC in the U.S.). Scam brokers often list fake or unverifiable licenses. In the case of Capitals Badge, their claims of regulation by major global authorities could not be confirmed through official registers. That’s a major red flag.

Here’s what you should do:

- Visit the website of the claimed regulator.

- Search for the broker’s license number or company name.

- If you can’t find them, it’s likely a fraudulent claim.

3. No Transparent Company Information

Trustworthy brokers provide detailed company background, including office addresses, management team bios, and contact information. Capitals Badge offers vague, unverifiable data about its leadership and physical presence, which is a common tactic to avoid accountability. Often, fraudulent brokers will provide fake addresses or use virtual office services to appear legitimate.

The Final Verdict: Protect Yourself and Recover Your Losses with Stop-Scam

After a deep dive into the operations and structure of Capitals Badge, the evidence is overwhelmingly clear: this entity is not a legitimate financial broker, but a carefully constructed scam designed to steal money from unsuspecting investors. Despite presenting itself as a seasoned, regulated, and international trading platform, every claim made by Capitals Badge falls apart under scrutiny. From unverifiable regulatory claims to a lack of transparency, misleading investment offers, and multiple victim reports—Capitals Badge checks nearly every box on the fraud checklist.

Let’s recap the core issues:

1. False Regulatory Claims

Capitals Badge has boasted of being regulated by top-tier authorities such as the FCA (UK), KNF (Poland), and CMB (Turkey). However, a thorough check of each of these regulators’ official databases yields no matching entries. This type of deception is not only illegal but also extremely dangerous to investors, as it creates a false sense of security. Real brokers are always listed and searchable in regulatory databases, and they provide license numbers that can be independently verified.

2. Fabricated Returns and Bonuses

Offering daily returns of up to 10% is completely unrealistic and unsustainable. No legitimate trading platform can guarantee such profits. It’s a typical Ponzi-style tactic—used to attract quick investments under false pretenses, all while preparing to defraud victims later down the line.

3. Obstructed Withdrawals and Fake Fees

Perhaps the most painful red flag is the widespread issue of denied withdrawals. Clients who tried to withdraw their earnings were asked to pay additional “taxes” or fees upfront—fees that turned out to be fabricated. Once paid, the funds still weren’t released. This is a textbook scam maneuver. The fraudsters keep demanding more money until the victim finally gives up or realizes the deception.

Capitals Badge’s platform appeared sophisticated, and their representatives were persuasive. However, after depositing funds, I noticed discrepancies in my account statements. When I questioned them, communication ceased. It’s clear now that this was a scam. I’m documenting my experience to warn others and seek legal advice on possible recourse.

You are absolutely right, if you were deceived by this company, leave a request with us and our specialist will contact you for a free consultation!

I was approached by Capitals Badge through social media, where they showcased impressive trading results. After investing, I was unable to access my funds, and their support team vanished. It’s disheartening to fall victim to such schemes. I’m sharing my story to caution others and to find out if there are any organizations that can assist in fund recovery.

We will be happy to help you, leave a request on the website.

Capitals Badge claimed to offer expert trading advice and account management. After trusting them with my investment, I noticed unauthorized trades and losses. Attempts to contact them were futile. I believe they manipulated my account for their gain. I’m now seeking legal counsel to understand my options for recovering the lost funds.

Leave a request and we will help you.

I was enticed by Capitals Badge’s promise of quick profits. After depositing money, they kept pushing for more investments and refused withdrawal requests. Realizing the scam, I reported them to the financial authorities. I’m also looking into services that specialize in recovering funds from fraudulent brokers.

Specialists will contact you after you leave a request on the website.

Capitals Badge presented themselves as a reputable broker, but after investing, I faced constant delays and excuses when trying to withdraw my money. Their tactics are deceptive, and I want to ensure others are aware of their fraudulent activities. I’m currently compiling evidence to report them to the relevant regulatory bodies.

Our team will help you get your stolen money back, leave a request.