In the vast and often volatile world of online trading, investors are frequently lured by promises of high returns and user-friendly platforms. However, beneath these enticing offers can lie deceitful practices aimed at exploiting unsuspecting traders. One such entity that has come under scrutiny is Amexcypmarket. This broker has been flagged by various regulatory bodies and investor protection platforms as a potential scam, preying on individuals seeking financial growth.

Information About the Fraudulent Broker: Amexcypmarket

Amexcypmarket presents itself as a legitimate online trading platform, offering services in forex, commodities, and cryptocurrencies. The website, amexcypmarket.org, showcases a sleek design and promises advanced trading tools, aiming to instill confidence in potential clients. However, a deeper investigation reveals several red flags that suggest otherwise.

Lack of Regulatory Oversight

One of the most glaring issues with Amexcypmarket is its absence from any reputable financial regulatory body’s list. Regulatory bodies such as the UK’s Financial Conduct Authority (FCA) or the U.S. Securities and Exchange Commission (SEC) maintain strict oversight over financial institutions to protect investors. The lack of registration with these authorities indicates a significant risk for traders.

Concealed Company Information

Transparency is a cornerstone of trust in the financial industry. Amexcypmarket’s website fails to provide verifiable information about its company registration, physical address, or the identities of its executives. This deliberate obfuscation makes it challenging for investors to hold the company accountable or seek legal recourse in case of disputes.

Unverifiable Contact Details

Legitimate brokers offer multiple channels for customer support, including phone numbers, email addresses, and live chat options. Amexcypmarket, however, provides limited contact information, often redirecting users to generic email addresses or contact forms. This lack of direct communication channels raises concerns about the company’s willingness to address client issues.

Verification of Company Data: Scrutinizing the Broker’s Legitimacy

Upon attempting to verify Amexcypmarket’s legitimacy, several inconsistencies and lack of verifiable information emerge.

Domain Analysis

The domain amexcypmarket.org is relatively new, registered in early 2024. Scam websites often operate under newly registered domains to avoid detection and to quickly disappear after scamming clients. The short lifespan of this domain is a significant concern.

WHOIS Information

A WHOIS lookup reveals that the domain registration details are obscured using privacy protection services. While this can be a common practice to protect personal information, it also prevents potential clients from verifying the legitimacy of the company’s ownership and location.

Absence of Regulatory Licenses

Despite claims of offering financial services, Amexcypmarket does not display any regulatory licenses from recognized authorities. The absence of such credentials is a strong indicator that the broker operates outside the legal frameworks designed to protect investors.

Exposing the Broker as a Fraudster: Identifying Deceptive Practices

Amexcypmarket employs several deceptive tactics to lure and exploit traders:

Promises of High Returns

The broker entices potential clients with promises of high returns on investments, often showcasing testimonials and fabricated success stories. These exaggerated claims are designed to lure individuals into depositing funds.

Manipulated Trading Platforms

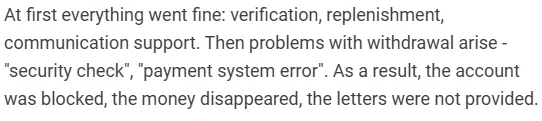

Once clients deposit funds, they are directed to trading platforms that appear functional but are rigged to prevent withdrawals. Trades may be manipulated, and clients often find their accounts locked or frozen when attempting to access their funds.

Withdrawal Issues

A common complaint among victims is the inability to withdraw funds. Requests for withdrawals are either ignored or met with unreasonable conditions, such as additional fees or the need to meet specific trading volumes before funds can be released.

Pressure Tactics

Some clients report being pressured into making additional deposits or signing agreements that waive their rights, under the guise of securing their investments or ensuring withdrawals.

Fraud Broker’s Deception Scheme: Understanding the Modus Operandi

Amexcypmarket’s fraudulent scheme operates through a well-orchestrated process:

- Initial Contact: Potential clients are approached via unsolicited emails, social media ads, or pop-up ads, promising lucrative investment opportunities.

- Account Setup: Interested individuals are guided to set up accounts on the broker’s platform, often with minimal verification processes.

- Deposit Funds: Clients are encouraged to deposit funds into their accounts, with the broker often matching or increasing the initial deposit to entice further investment.

- Trading Activity: Clients engage in trading, with some experiencing initial success to build trust.

- Withdrawal Attempts: When clients attempt to withdraw their earnings, they encounter various obstacles, including account freezes, excessive fees, or demands for additional documentation.

- Final Stage: Ultimately, clients are unable to access their funds, and the broker may disappear, leaving no trace.

How to Get Money Back from a Scam Broker: Seeking Recovery with Stop-Scam Specialists

If you’ve fallen victim to Amexcypmarket, it’s crucial to act swiftly:

Document Everything

Keep detailed records of all communications, transactions, and agreements with the broker. This documentation will be vital in any recovery efforts.

Contact Financial Authorities

Report the incident to financial regulatory bodies in your country. In Ukraine, for instance, the National Securities and Stock Market Commission (NSSMC) can be alerted. They may provide guidance or take action against the fraudulent entity.НКЦПФР

Engage with Recovery Experts

Specialized firms like Stop-Scam have experience in dealing with fraudulent brokers. They can assist in tracing funds, filing complaints, and pursuing legal avenues to recover lost assets.

Legal Action

Depending on the jurisdiction and the amount involved, pursuing legal action against the broker may be an option. Consulting with a lawyer specializing in financial fraud can provide clarity on this path.

Negative Reviews About the Broker: Voices of the Affected Clients

Victims of Amexcypmarket have shared their experiences on various platforms:

- Sophia’s Story: Sophia invested over $230,000 with Amexcypmarket. After initial successful trades, her withdrawal requests were declined without explanation. Despite contacting customer service, she received no meaningful response, leading to a complete loss of her capital.

- Xingbanyue’s Experience: An investor from Hong Kong reported being unable to withdraw funds after making significant profits. The broker accused them of violating trading rules due to the absence of losses and demanded a 30% fee to release the funds. After complying, the investor received only a portion of their funds, with the remainder withheld and their account closed.

These accounts highlight a consistent pattern of deceitful practices aimed at exploiting traders.

Red Flags to Watch Out For

When dealing with online brokers, be vigilant for the following warning signs:

- Unrealistic Promises: Be wary of brokers guaranteeing high returns with little to no risk.

- Lack of Transparency: Avoid brokers that do not provide clear information about their company, regulatory status, or contact details.

- Pressure Tactics: Steer clear of brokers that pressure you into making quick decisions or additional deposits.

- Withdrawal Issues: If you encounter difficulties withdrawing funds, it’s a significant red flag.

Always conduct thorough research and consider seeking advice from financial experts before engaging with any online trading platform.

The Result: Safeguarding Your Investments

In conclusion, while Amexcypmarket may present itself as a legitimate trading platform, numerous indicators suggest otherwise. The absence of regulatory oversight, concealed company information, and reports of fraudulent activities point to a high likelihood of it being a scam.

If you’ve been affected, it’s essential to take prompt action. Document all interactions, report the incident to relevant authorities, and consider seeking assistance from specialized firms like Stop-Scam. They can guide you through the process of recovering your funds and holding the fraudulent broker accountable.

Remember, your vigilance and prompt action can make a significant difference in protecting your financial interests.