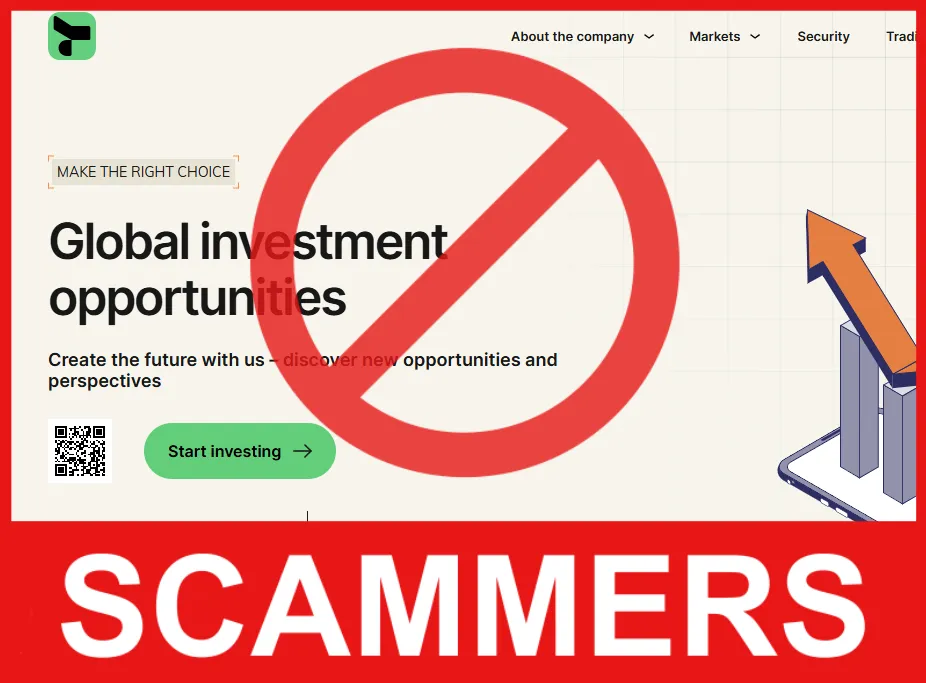

In the digital age, online trading has become increasingly popular, offering people a way to grow their wealth through investments in various financial assets. However, with the rise of online trading platforms, there has also been a surge in fraudulent brokers preying on unsuspecting traders. One such broker is Tilzurvo, which claims to offer professional trading services but has been accused of engaging in various fraudulent activities. This article aims to provide an in-depth analysis of Tilzurvo, exposing its deceptive practices and offering guidance for affected individuals on how to recover their funds with the help of Stop-Scam specialists.

Tilzurvo: Company Overview and Operations

Tilzurvo presents itself as a trading platform offering a range of account types: Elementary, Medium, and Exclusive, with minimum deposits starting at $100, $1,000, and $10,000, respectively. These accounts promise access to various trading tools, real-time market data, and secure transactions. The broker claims to have a presence in Larnaca, Cyprus, and lists licenses from prestigious regulatory bodies like CySEC (Cyprus Securities and Exchange Commission), DFSA (Dubai Financial Services Authority), and the UK’s FCA (Financial Conduct Authority).

On the surface, Tilzurvo’s offerings seem to align with those of legitimate brokers, but things quickly take a turn when one digs deeper. While these grandiose claims may sound reassuring, there is a distinct lack of transparency regarding their operations. Essential details about the company’s ownership, management, or physical office locations remain unclear, which is a significant red flag. Moreover, their website offers only basic information about the platform and little to no details about its operational history, leaving potential investors in the dark about who is behind the company and how it operates.

Verifying Tilzurvo’s Credentials: A Closer Look

One of the most concerning issues with Tilzurvo is the dubiousness of its regulatory claims. The broker asserts that it is licensed by multiple well-known regulators, such as CySEC, DFSA, and FCA. However, a search of these regulators’ official databases reveals no record of Tilzurvo being licensed or authorized to operate under these prestigious bodies. Such discrepancies are often a clear sign of a scam, as legitimate brokers are typically registered with financial authorities, and their information is easily accessible on official websites.

Additionally, the contact details provided on Tilzurvo’s website are highly suspect. The physical address in Cyprus seems to be fictitious, with no known connection to any financial institution. When trying to reach their customer support team, many investors report delayed or no responses, further contributing to the growing concerns about the company’s reliability and legitimacy. Such issues are often indicative of a platform operating without regulatory oversight or transparency.

In most cases, fraudulent brokers will attempt to establish a sense of credibility by falsely claiming licenses or partnerships with well-known organizations. These empty claims are designed to manipulate and convince unsuspecting investors into trusting the platform and depositing their hard-earned money. Tilzurvo’s lack of a verifiable regulatory presence should be an immediate warning sign to anyone considering investing with the platform.

Exposing Tilzurvo’s Fraudulent Activities

There are several alarming signs that suggest Tilzurvo is engaging in dishonest and fraudulent practices:

- Lack of Transparency: The company offers minimal details about its operations, ownership, and team members. Reputable brokers usually have transparent information about who is behind the platform and provide clear insights into how the platform functions. Tilzurvo’s reluctance to share such information raises doubts about its authenticity.

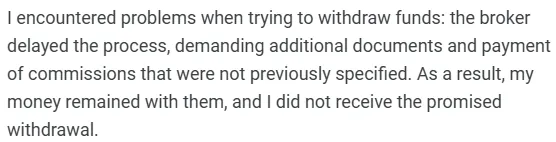

- Difficulties with Withdrawals: One of the most common complaints from victims of fraudulent brokers is an inability to withdraw funds. Many Tilzurvo clients have reported encountering significant difficulties when trying to access their money. In some cases, clients have had their withdrawal requests ignored entirely, while others have been subjected to unexpected fees, taxes, or conditions that prevent them from accessing their funds. This is a typical tactic used by fraudulent brokers to retain clients’ money and discourage withdrawal requests.

- Aggressive Marketing and Pressure Tactics: Tilzurvo employs high-pressure sales tactics, such as cold calls, unsolicited emails, and targeted online ads, to lure potential investors. These tactics often promise high returns with minimal risk, making it tempting for individuals to invest. However, such promises are rarely ever fulfilled, and investors are often left with financial losses and no way of contacting the broker.

- Unsubstantiated Licensing Claims: As mentioned earlier, Tilzurvo falsely claims to be licensed by several top regulatory bodies. This is a tactic commonly used by scam brokers to appear legitimate and gain the trust of potential clients. However, a lack of verifiable licensing is one of the most significant red flags that should raise immediate concern for anyone considering investing with the platform.

Understanding Tilzurvo’s Deceptive Schemes

The scam schemes used by Tilzurvo follow a well-known pattern that many fraudulent brokers employ to maximize profits at the expense of unsuspecting investors. Below is a breakdown of how Tilzurvo’s fraudulent system works:

- Attracting Investors: Tilzurvo uses a combination of targeted advertising, cold calls, and aggressive marketing strategies to attract new customers. These methods often highlight the promise of high returns with little to no risk, which is a classic lure for new investors. The company creates a false sense of trust by emphasizing its supposed regulatory licenses and presenting itself as a reputable trading platform.

- Initial Profits: In the beginning, new traders may experience small gains that encourage them to continue investing. This tactic is used to build trust and convince clients to deposit larger amounts of money, believing that the broker is legitimate and capable of delivering profits.

- Delays and Obstructions: Once the investor has made significant deposits, the scam begins to unravel. Clients often face difficulties when trying to withdraw funds, with the company citing fake issues such as technical problems, unexpected taxes, or additional fees. These tactics are designed to prevent traders from accessing their funds, pushing them to make even more deposits in the hope of resolving the issues.

- Complete Disappearance: Eventually, when investors attempt to withdraw their remaining funds or seek clarification, Tilzurvo ceases communication entirely. Their customer support team becomes unreachable, and any remaining funds are essentially lost. This is the final stage of a fraudulent broker’s scam, after which the company vanishes, leaving clients stranded and without recourse.

How to Recover Money from a Scam Broker with Stop-Scam’s Assistance

If you find yourself a victim of Tilzurvo’s fraudulent activities, the first step is to reach out to Stop-Scam, a law firm dedicated to helping victims of financial fraud. Their team of experts specializes in recovering funds from unscrupulous brokers and can guide you through the process of reclaiming your lost money.

Stop-Scam offers the following services to help you recover your funds:

- Case Evaluation: The first step is to assess the details of your case to determine the best course of action. Stop-Scam experts will review your situation, including the amount of money involved and the details of your communication with Tilzurvo, to craft a personalized recovery strategy.

- Chargeback Assistance: If you used a credit card or bank transfer to deposit funds, Stop-Scam can help initiate a chargeback process, which may allow you to recover your money directly through your bank or credit card provider.

- Legal Action: In cases where other avenues have been exhausted, Stop-Scam can pursue legal action on your behalf, seeking compensation through courts or other legal channels. Their extensive experience with financial fraud cases increases your chances of success.

By working with professionals like Stop-Scam, you significantly increase the likelihood of recovering your funds and holding Tilzurvo accountable for its actions.

Client Testimonials and Negative Reviews

A search of online forums and review websites reveals numerous complaints from individuals who claim to have been scammed by Tilzurvo. These negative reviews provide critical insight into the company’s modus operandi and the types of fraudulent tactics it employs:

- Oleg: “I made a small initial deposit, and within a few weeks, I was told I had made a profit. But when I tried to withdraw the funds, the company kept asking for more money to cover hidden fees. Eventually, they stopped responding altogether.”

- Katya: “At first, everything seemed fine. But when I tried to withdraw my funds, they started creating all sorts of obstacles. After a while, they just ignored my withdrawal requests. I feel completely deceived.”

These personal accounts reflect a pattern of frustration and financial loss that many investors have experienced with Tilzurvo.

Protecting Yourself from Fraudulent Brokers

To avoid falling victim to scams like Tilzurvo, it is essential to take certain precautions:

- Verify Licensing: Always check the licensing status of any broker by consulting official regulatory bodies. Reputable brokers will be registered with recognized regulators, and their information will be readily available on official websites.

- Research Reviews: Before committing any funds, research the broker thoroughly. Look for independent reviews and testimonials from other clients to get a sense of their experiences.

- Be Skeptical of Unrealistic Promises: If a broker promises unusually high returns with little or no risk, proceed with caution. High returns often come with significant risks, and no legitimate broker would guarantee profits.

- Avoid Pressure Tactics: Fraudulent brokers often use high-pressure tactics to push investors into making quick decisions. Legitimate brokers allow their clients time to think through investments carefully.

By exercising caution and conducting thorough research, you can significantly reduce the risk of falling victim to fraudulent brokers like Tilzurvo.

Conclusion: Vigilance is Key

Tilzurvo has shown many signs of being a fraudulent broker, from unverifiable licensing claims to obstructing client withdrawals. These actions are designed to deceive and exploit investors for financial gain. However, victims of Tilzurvo’s practices are not without recourse. By working with professionals at Stop-Scam, individuals can increase their chances of recovering their funds and holding the broker accountable for their actions.

It is essential to remain vigilant and informed in the world of online trading. With the right knowledge and guidance, you can protect your investments from falling into the hands of fraudulent brokers. Always remember that being cautious and conducting thorough research is the best defense against financial scams.