In today’s global financial environment, investors must exercise caution when choosing trading platforms or brokers. While many legitimate brokers offer competitive services, there are also unscrupulous individuals and entities who set up fraudulent operations with the sole intention of deceiving and stealing from their clients. One such fraudster that has recently surfaced is Abundant Thrive, a platform that markets itself as a reputable broker for online trading but has been involved in multiple deceptive activities. This article will explore the details of Abundant Thrive’s fraudulent practices, including how it operates, the methods it uses to scam investors, and what you can do to protect yourself and recover any lost funds with the help of experts like Stop-Scam Law Firm.

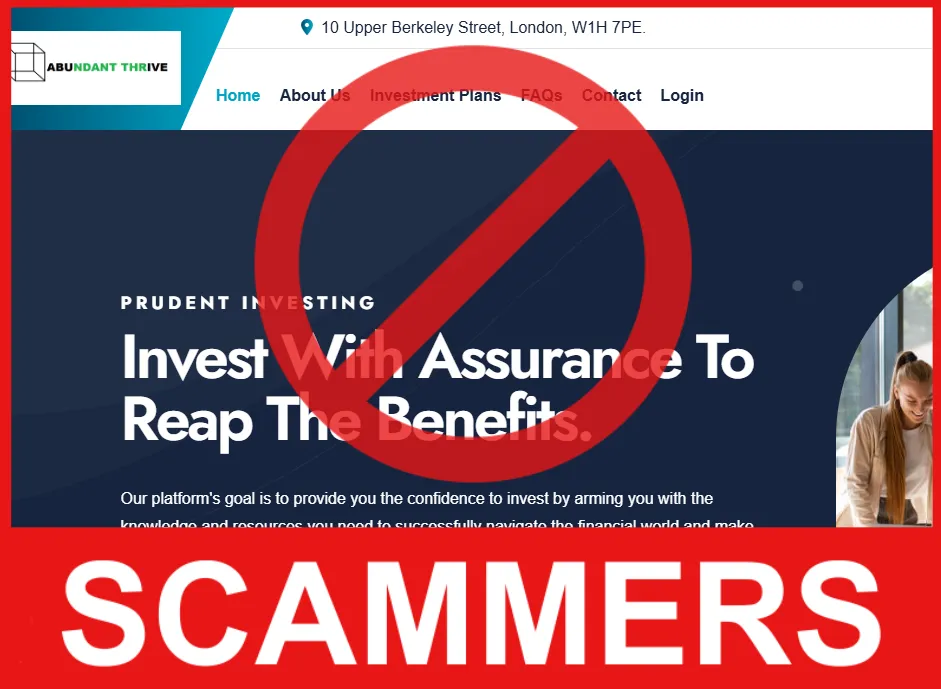

Information About the Fraudulent Broker: Abundant Thrive – A False Promise of Wealth

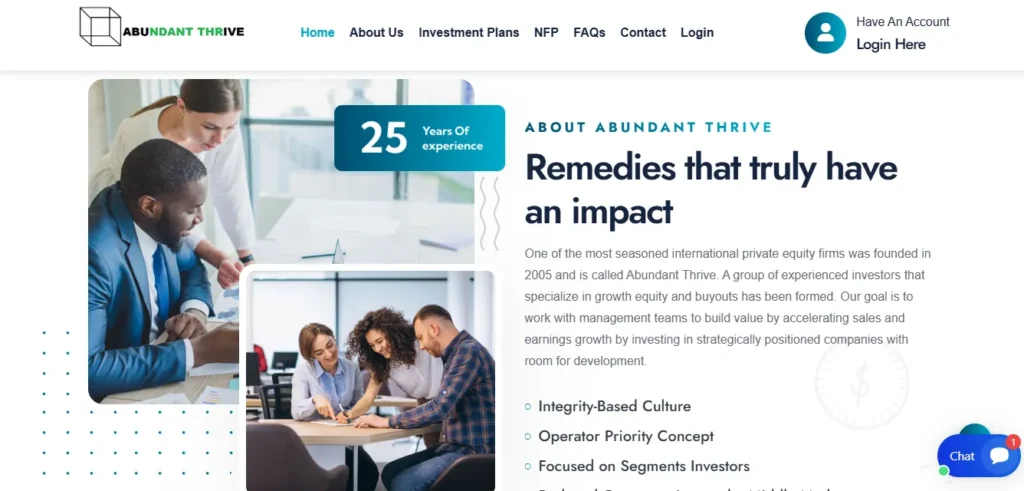

Abundant Thrive presents itself as a financial broker offering trading opportunities across various markets, including Forex, stocks, commodities, and cryptocurrencies. On its website, the broker claims to provide a seamless trading experience with advanced tools, high leverage, and exceptional customer support. However, several red flags point to its true nature as a fraudulent entity.

The website itself is professionally designed to attract potential investors, with promises of high returns and detailed educational resources. This façade is part of a larger scheme to lure in unsuspecting traders. However, once clients deposit funds into their accounts, they quickly discover that they cannot access their money, make withdrawals, or even contact customer support. Many have reported suspicious activity with their accounts, such as sudden fluctuations in balance, account freezes, and even manipulation of trading results.

Abundant Thrive operates without sufficient transparency. The names of its team members are often missing, and there is little to no verifiable information about the company’s headquarters, licenses, or regulatory compliance. Its apparent goal is not to provide a legitimate trading platform but to trick investors into investing money with no intention of allowing them to profit or retrieve their funds.

Verification of Company Data: How to Spot the Red Flags

Before engaging with any broker, it’s essential to verify the legitimacy of the company behind it. Legitimate brokers are typically registered with financial regulatory bodies and provide clear information about their corporate structure, licenses, and trading practices. Unfortunately, Abundant Thrive does not meet these basic standards.

Missing Regulatory Licenses and Legal Information

Abundant Thrive fails to show any credible regulatory licenses. Financial regulators such as the UK’s Financial Conduct Authority (FCA), the U.S. Commodity Futures Trading Commission (CFTC), or other international authorities have no record of the broker being authorized. This is a clear indication that Abundant Thrive operates outside of the legal frameworks that protect traders.

Additionally, the company’s address is either incomplete or nonexistent in its legal documentation. Reputable brokers list a physical office location, often in a jurisdiction where financial laws protect investors. In Abundant Thrive’s case, the lack of such transparency is a critical warning sign that it is not a legitimate business entity.

Unverified Claims and Dubious Testimonials

Another red flag is the presence of unverified and overly positive testimonials on Abundant Thrive’s website. Many scam brokers use fake reviews or hire individuals to write glowing reports about their services. Real traders, on the other hand, share their experiences on independent forums, often uncovering the truth about fraudulent platforms.

Abundant Thrive’s claim to provide “exceptional customer service” is unsubstantiated. Multiple victims have reported that when they attempted to contact customer support, they received no responses, or worse, were met with generic replies that failed to address their concerns.

Exposing the Broker as a Fraudster: Recognizing the Telltale Signs of a Scam

Fraudulent brokers like Abundant Thrive rely on deceptive tactics to build trust and convince potential clients to deposit funds. Here are some key signs to look out for that point to Abundant Thrive as a scam:

Lack of Transparency and High-Pressure Sales Tactics

Abundant Thrive uses high-pressure tactics to get clients to deposit large sums of money into their trading accounts. The brokers behind the platform may engage in constant calls or emails, pushing for quick sign-ups, which is a classic sign of a scam. A legitimate broker gives its customers time to think and doesn’t rush them into making decisions.

Moreover, the lack of transparency regarding the broker’s operational processes or how it handles client funds is another significant red flag. Many clients have reported difficulties in withdrawing their money, which is one of the most common signs of a fraudulent broker.

Fake or Inflated Trading Results

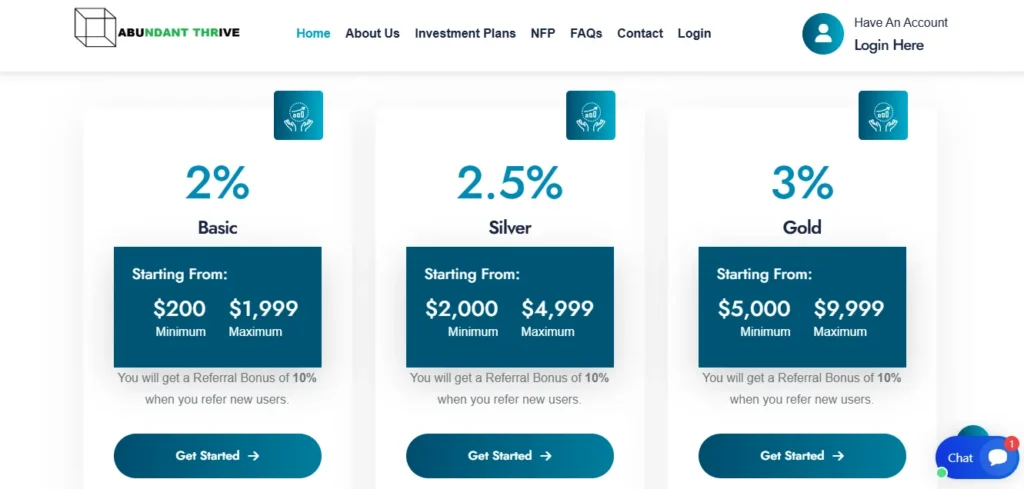

Once funds are deposited, clients may be told that their trades are generating profits. However, these gains are often fake or inflated. Abundant Thrive may show fictitious account balances to convince the trader that they are successful, only for the funds to be inaccessible when withdrawal requests are made. If it sounds too good to be true, it usually is.

Withdrawals and Account Lockdowns

One of the hallmark signs of fraudulent brokers is the sudden inability to make withdrawals. Clients of Abundant Thrive have reported being unable to access their earnings or their initial investment after trying to request a withdrawal. Often, clients are told that their withdrawal request is under review or that they must meet certain unreasonably high trading volume requirements before funds can be released.

Fraud Broker’s Deception Scheme: How They Trap You

Abundant Thrive uses several deceptive tactics to ensnare investors, and understanding these schemes is essential for preventing future scams. Here’s a breakdown of how the fraud works:

Luring Clients with Unrealistic Promises

The first step in the scam involves advertising high returns on investments that are impossible to achieve through legitimate means. These advertisements often target people who are new to trading or desperate for quick financial gains. Abundant Thrive promises low-risk trading with high rewards, preying on the emotions of those looking to make easy money.

Initial Small Withdrawals to Build Trust

Once an investor deposits money and begins trading, the broker might allow a small withdrawal to make the victim believe the platform is legitimate. Afterward, they make it increasingly difficult for clients to withdraw larger sums. At this point, the victim is led to believe that they can make more money if they just invest a little more, which results in further losses.

Sudden Loss of Funds or Account Lockdown

As the scam progresses, the broker may freeze the account, claiming technical difficulties or regulatory issues. The client is left with no way to access their funds, and the fraudster disappears with the money.

How to Get Your Money Back from a Scam Broker: Seeking Help from Stop-Scam Experts

If you’ve been deceived by Abundant Thrive or any other fraudulent broker, there is hope. Specialists like Stop-Scam Law Firm are experienced in recovering funds lost to unscrupulous brokers. They can guide you through the process of filing complaints with regulatory authorities, investigating the broker’s activities, and even pursuing legal action.

Steps to Recover Your Funds:

- Contact Stop-Scam – The first step is to get in touch with a legal professional at Stop-Scam Law Firm who will assess your case.

- Gather Documentation – Collect all relevant records, including account statements, emails, and communication logs with the broker. The more information you can provide, the stronger your case will be.

- Report to Authorities – Stop-Scam will help you file reports with financial regulators and authorities that can take legal action against fraudulent brokers.

- Legal Action – In cases where the fraudster is uncooperative, Stop-Scam can pursue legal means to recover your funds through court orders or international financial recovery channels.

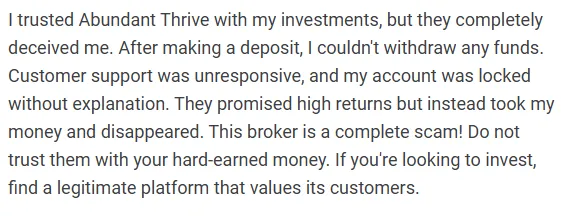

Negative Reviews About Abundant Thrive: The Voice of the Victims

One of the most reliable ways to identify a fraudulent broker is by looking at the experiences of others. Numerous traders have reported negative experiences with Abundant Thrive, citing difficulties with withdrawals, hidden fees, and broken promises.

Victims have expressed frustration with the lack of support when trying to resolve issues, as well as the sudden disappearance of funds from their trading accounts. Many have also shared their stories on online forums, warning others about the deceptive nature of the broker. These firsthand accounts serve as a crucial warning for anyone considering using Abundant Thrive.

A Final Word of Caution: Protect Yourself from Scam Brokers

In the world of online trading, it’s essential to exercise caution and be aware of the signs of fraudulent brokers like Abundant Thrive. Always check for proper regulation, read independent reviews, and avoid platforms that push high-risk investments with unrealistic promises.

If you suspect you have fallen victim to a scam, contact Stop-Scam Law Firm immediately to start the recovery process. The sooner you act, the higher the chances of reclaiming your lost funds.

Conclusion: The Importance of Seeking Professional Help from Stop-Scam

Abundant Thrive is a textbook example of a fraudulent broker using deceitful practices to lure unsuspecting traders. By recognizing the signs of a scam and seeking professional help from specialists like Stop-Scam Law Firm, you can protect yourself and increase your chances of recovering your funds. Remember, it’s never too late to take action, and with the right help, you can reclaim your hard-earned money.