In the ever-evolving world of online trading, platforms promising high returns and user-friendly interfaces often attract investors seeking to capitalize on market opportunities. However, not all that glitters is gold. Elevate Trader, a platform that has garnered attention in the trading community, has come under scrutiny for practices that raise red flags for potential investors. This article delves into the details of Elevate Trader, examining its operations, regulatory standing, deceptive tactics, and the experiences of those who have fallen victim to its schemes. Additionally, we will explore avenues for recovering funds lost to such fraudulent platforms, emphasizing the importance of vigilance and due diligence in the online trading arena.

Information About the Fraudulent Broker: Elevate Trader

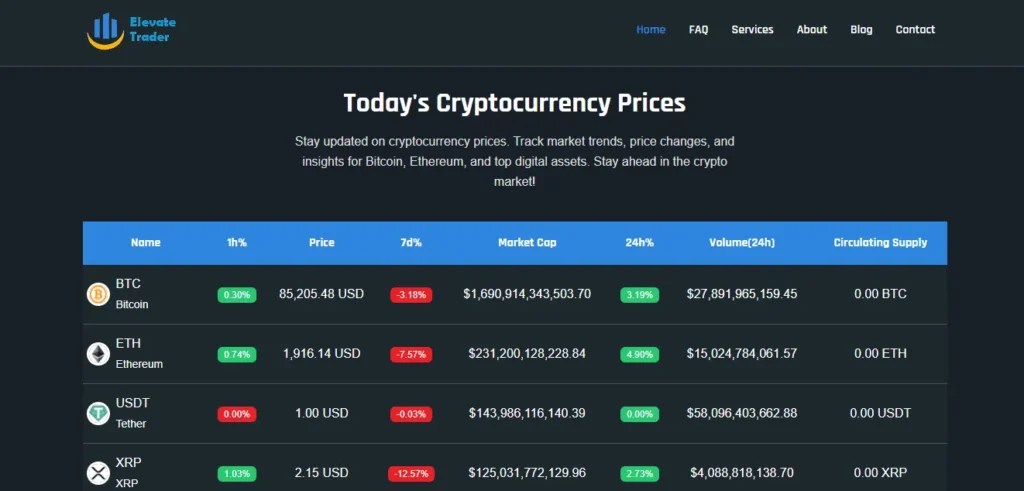

Elevate Trader presents itself as a modern online trading platform offering high payouts, low spreads, and real-time analytics. The website claims to provide a secure and fast trading environment, catering to both novice and experienced traders. However, a closer inspection reveals several concerning aspects that cast doubt on its legitimacy.

Lack of Regulatory Oversight

One of the most glaring issues with Elevate Trader is its absence of regulation by any recognized financial authority. Legitimate trading platforms are typically registered with regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the U.S. Securities and Exchange Commission (SEC). The absence of such affiliations raises questions about the platform’s adherence to industry standards and investor protection laws.

Anonymity of Ownership

The platform’s website does not disclose detailed information about its ownership or the team behind it. Transparency is a key indicator of a legitimate business, and the lack of such information on Elevate Trader’s site is a significant cause for concern.

Unverifiable Claims

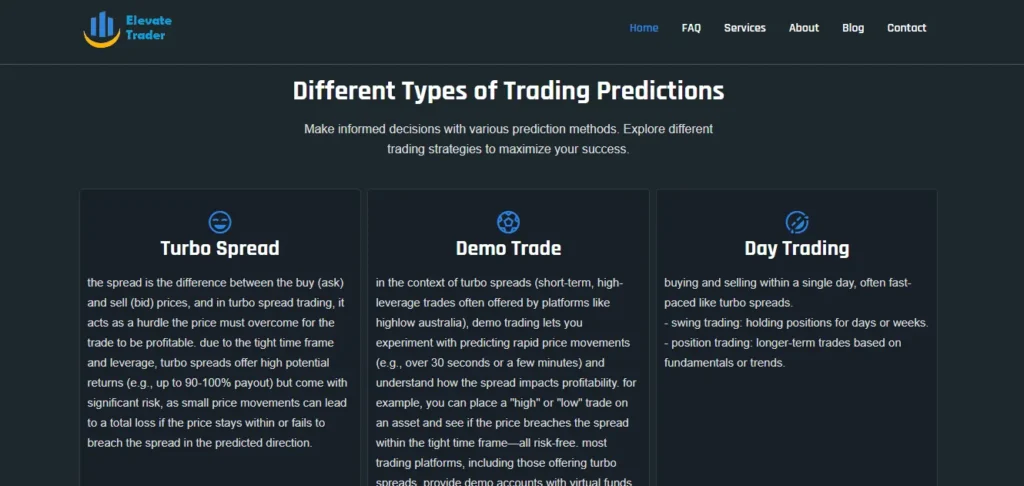

Elevate Trader boasts about its trading tools and features, including “turbo spread” options and high payout rates. However, these claims lack verifiable evidence or third-party audits to substantiate their accuracy. In the trading industry, such unverifiable promises often serve as bait to lure unsuspecting investors.

Verification of Company Data

Upon attempting to verify Elevate Trader’s company data, several inconsistencies and red flags emerge:

Domain Registration Details

The website’s domain registration information is obscured using privacy protection services, making it difficult to ascertain the true identity of the entity behind Elevate Trader. While privacy protection is common, it can also be a tactic used by fraudulent platforms to conceal their identity.

Absence of Physical Address

Legitimate companies typically provide a physical business address on their websites. Elevate Trader fails to do so, further obscuring its legitimacy and making it challenging for investors to pursue legal action if necessary.

Lack of Contact Information

While the website offers a contact form, there is no direct phone number or email address provided for customer support. This lack of accessible communication channels is a common trait among fraudulent platforms, as it hinders investors from seeking assistance or reporting issues.

Exposing the Broker as a Fraudster

Several signs indicate that Elevate Trader operates as a fraudulent entity:

Promises of High Returns with Low Risk

Elevate Trader advertises high payouts and low spreads, often associated with high-risk trading instruments. Such promises are typical of scams, as they lure investors with the prospect of quick profits without disclosing the inherent risks involved.

Difficulty with Withdrawals

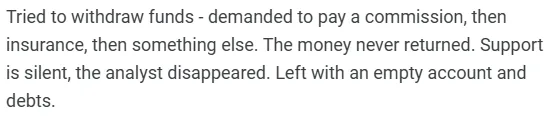

Reports from users suggest that while depositing funds into Elevate Trader is straightforward, withdrawing them proves challenging. Many have reported delays, unresponsiveness, or outright denial of withdrawal requests—a classic tactic used by fraudulent platforms to retain investors’ funds.

Aggressive Marketing Tactics

Elevate Trader employs aggressive marketing strategies, including unsolicited messages and pressure tactics, to recruit new investors. These methods are characteristic of Ponzi schemes, where new investments are used to pay returns to earlier investors, creating a facade of legitimacy.

Fraud Broker’s Deception Scheme

Elevate Trader’s deceptive scheme appears to operate as follows:

- Attractive Onboarding: New users are enticed with promises of high returns and user-friendly trading tools, encouraging them to deposit funds.

- Initial Engagement: Once funds are deposited, users are provided with access to the trading platform, which may initially appear functional.

- Increased Investment Requests: Users are encouraged to invest more, often through personalized communication from alleged account managers.

- Withdrawal Difficulties: When users attempt to withdraw their funds, they encounter various obstacles, including delays, unresponsiveness, or outright denial.

- Escalation of Pressure: In some cases, users report being pressured to invest more or threatened with account suspension if they persist with withdrawal requests.

This cycle continues, with the platform profiting from the initial investments while users struggle to reclaim their funds.

How to Get Money Back from a Scam Broker

Recovering funds from a fraudulent platform like Elevate Trader can be challenging, but it’s not impossible. Here’s how victims can take action:

1. Document Everything

Keep detailed records of all communications, transactions, and attempts to withdraw funds. This documentation will be crucial in any legal proceedings or claims.

2. Report to Regulatory Authorities

File complaints with relevant regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the U.S. These organizations can investigate the matter and may take enforcement actions.

3. Contact Financial Institutions

If you made deposits using credit cards or bank transfers, contact your financial institution to dispute the charges. Some banks offer chargeback services that may help recover funds.

4. Seek Legal Assistance

Engage with legal professionals who specialize in financial fraud. Law firms experienced in handling cases against fraudulent brokers can provide guidance and representation.

5. Utilize Fund Recovery Services

There are specialized services dedicated to helping victims of online trading scams recover their funds. These services often work on a contingency basis, meaning they only get paid if they successfully recover your money.

Negative Reviews About the Broker

Victims of Elevate Trader have shared their experiences online, shedding light on the platform’s deceptive practices:

- Difficulty with Withdrawals: Many users report that while depositing funds is easy, withdrawing them is nearly impossible. Complaints include unresponsive customer support and unexplained delays.

- Aggressive Sales Tactics: Users have described being bombarded with unsolicited messages and pressured to invest more money, even after expressing reluctance.

- Unprofessional Communication: Some victims note that communications from Elevate Trader lack professionalism, with account managers using high-pressure tactics and providing vague information.

These reviews align with common characteristics of fraudulent trading platforms, reinforcing concerns about Elevate Trader’s legitimacy.

Recognizing Common Signs of Trading Scams

While Elevate Trader exhibits several red flags, it’s essential to recognize common signs of trading scams to protect oneself in the future:

1. Unrealistic Promises

Be wary of platforms that promise guaranteed returns or high profits with little to no risk. All investments carry some level of risk, and any platform claiming otherwise is likely a scam.

2. Lack of Regulation

Legitimate trading platforms are typically regulated by recognized financial authorities. The absence of such regulation is a significant warning sign.

3. Pressure to Invest

Scammers often use high-pressure tactics to encourage quick investments. Take your time to research and consider your options before committing funds.

4. Limited Contact Information

A lack of accessible customer support or contact information can indicate a fraudulent platform. Always ensure you can reach the company through multiple channels.

5. Negative Online Reviews

Researching online reviews can provide insight into other users’ experiences. Consistent complaints about withdrawal issues or unprofessional conduct are red flags.

The Result: Protecting Yourself and Seeking Justice

Elevate Trader exemplifies the deceptive practices employed by fraudulent online trading platforms. By understanding the signs of such scams and taking proactive steps, investors can protect themselves from falling victim to similar schemes.

If you have been affected by Elevate Trader or a similar platform, it’s crucial to take action promptly. Document all interactions, report the incident to relevant authorities, and seek professional assistance to recover your funds. Remember, while the road to recovery may be challenging, resources and support are available to help you navigate the process and seek justice for the wrongs committed against you.