In the ever-evolving world of cryptocurrency investments, numerous platforms claim to offer lucrative returns. However, not all are as trustworthy as they appear. One such platform, Extendedcoins, presents itself as a high-yield investment opportunity. Yet, beneath its polished exterior lies a fraudulent scheme designed to deceive unsuspecting investors. This article delves into the details of Extendedcoins, exposing its deceptive practices and providing guidance on how victims can seek restitution with the assistance of Stop-Scam law firm.

Information About the Fraudulent Broker: Extendedcoins

Extendedcoins markets itself as a cryptocurrency investment platform offering various plans with daily profits ranging from 3% to 14%, depending on the investment amount and duration. The platform boasts services like mining, trading, and crypto-backed loans, aiming to attract both novice and experienced investors. Its website, extendedcoins.com, features sleek design elements and promises of high returns, creating an illusion of legitimacy.

However, a closer examination reveals several red flags. The company provides minimal information about its founders or operational team, and its contact details are generic, including a non-specific email address and a phone number without verifiable ownership. Additionally, the platform lacks transparency regarding its regulatory status and does not provide verifiable information about its physical location or licensing, which are crucial indicators of a legitimate financial entity.

These omissions and inconsistencies are characteristic of fraudulent schemes that prey on individuals seeking high returns in the cryptocurrency market.

Verification of Company Data: Scrutinizing the Legitimacy of Extendedcoins

Upon attempting to verify the legitimacy of Extendedcoins, several discrepancies and lack of verifiable information come to light. The platform’s website does not provide any details about its registration, regulatory compliance, or affiliations with recognized financial authorities. A legitimate investment firm typically displays its regulatory licenses and affiliations prominently to instill confidence in potential investors.

Moreover, a search for Extendedcoins on reputable financial regulatory websites yields no results, indicating that the platform operates without oversight from any recognized financial authority. This absence of regulation is a significant warning sign, as it means investors have no legal recourse in case of disputes or fraudulent activities.

The lack of transparency and regulatory oversight further underscores the fraudulent nature of Extendedcoins, making it a high-risk platform for any investor.

Exposing the Broker as a Fraudster: Identifying Deceptive Practices

Extendedcoins employs several deceptive practices to lure and trap investors. One of the primary tactics is the promise of unrealistically high returns, such as 14% daily profits, which are not sustainable in legitimate investment environments. These promises create a sense of urgency and greed among potential investors, prompting them to invest without conducting thorough research.

Once investors deposit funds, they often encounter difficulties when attempting to withdraw their earnings. Common issues include account freezes, unresponsive customer support, and sudden changes in withdrawal policies, all designed to prevent investors from accessing their funds.

Additionally, Extendedcoins may employ tactics such as offering bonuses or incentives to encourage further investments, only to impose stringent withdrawal conditions or fees that make it nearly impossible for investors to retrieve their money.

These practices are indicative of a classic Ponzi scheme, where returns to earlier investors are paid using the capital of new investors, rather than from profit earned by the operation of a legitimate business.

Fraud Broker’s Deception Scheme: Understanding the Tactics

The deception scheme employed by Extendedcoins follows a typical pattern observed in many fraudulent investment platforms. Initially, the platform entices potential investors with attractive offers and high returns, often through targeted advertisements or social media promotions. Once an individual expresses interest, they are guided through a seamless registration and investment process, which appears professional and trustworthy.

After the initial investment, the platform may show positive returns to build trust and encourage further investments. However, as the investor attempts to withdraw their earnings, they encounter obstacles such as account freezes, unresponsive support, or sudden changes in withdrawal policies.

In some cases, Extendedcoins may request additional deposits under various pretexts, such as “verification fees” or “processing charges,” to delay or prevent withdrawals. These tactics are designed to create a sense of urgency and pressure the investor into complying without fully understanding the implications.

Ultimately, the platform’s goal is to extract as much money as possible from investors before disappearing or ceasing operations, leaving victims with no recourse.

How to Get Money Back from a Scam Broker: Assistance from Stop-Scam Specialists

If you’ve fallen victim to Extendedcoins or a similar fraudulent platform, it’s crucial to act promptly to recover your funds. The Stop-Scam law firm specializes in assisting individuals who have been defrauded by unscrupulous brokers. Here’s how they can help:

- Case Assessment: Stop-Scam specialists will review the details of your case, including transaction records and communication with the broker, to assess the viability of recovery.

- Legal Action: If applicable, the firm will initiate legal proceedings against the fraudulent platform, leveraging international laws and regulations to pursue the return of your funds.

- Collaboration with Authorities: Stop-Scam works closely with financial regulators and law enforcement agencies to investigate fraudulent activities and hold perpetrators accountable.

- Recovery Strategies: The firm employs various strategies, including chargeback requests, asset tracing, and negotiation with financial institutions, to recover lost funds.

- Ongoing Support: Throughout the recovery process, Stop-Scam provides regular updates and support, ensuring you’re informed and involved at every step.

By partnering with Stop-Scam, victims of Extendedcoins can increase their chances of recovering lost investments and seeking justice.

Negative Reviews About the Broker: Voices of the Victims

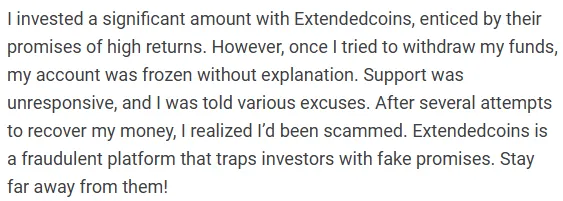

Victims of Extendedcoins have shared their experiences across various online forums, social media platforms, and review websites. These reviews highlight common themes of frustration, loss, and betrayal, painting a clear picture of the deceptive nature of this broker. Below, we delve into some of the recurring complaints and troubling stories from investors who have fallen prey to this fraudulent platform.

1. Account Freezes and Withdrawal Issues

One of the most consistent grievances from victims of Extendedcoins is the freezing of accounts once funds are deposited. Many users report that after they invested money, their accounts were blocked or restricted, preventing them from withdrawing their earnings. Several users have claimed that they were able to make deposits without issue, but as soon as they requested withdrawals, their accounts were suspended under vague pretenses.

In some cases, investors have alleged that they were told the platform was undergoing “maintenance” or facing “technical issues” when they tried to access their funds. This led to significant delays in withdrawals or, in some instances, the complete loss of their money.

2. Unresponsive Customer Support

Another recurring complaint among victims is the lack of response from Extendedcoins’ customer support. Many investors reported that when they attempted to contact the platform’s support team through email or phone, they received little to no reply. Some users were left in the dark for days or weeks without any updates regarding their withdrawal requests or account issues.

A few victims mentioned that after repeatedly reaching out to support, they eventually received generic responses, which did not address their specific issues. These unhelpful replies only fueled the growing suspicion that Extendedcoins was not interested in resolving customer complaints or returning funds, but was rather trying to buy time and keep investors in the dark.

How to Recognize Red Flags in Cryptocurrency Investment Platforms: Protecting Yourself from Fraud

When it comes to investing in cryptocurrencies, the allure of high returns often attracts many people, especially those who are new to the market. Platforms like Extendedcoins take advantage of this excitement, promising massive profits with minimal risk. Unfortunately, it’s easy for investors to get caught up in these promises, only to later realize that they have been deceived. In this section, we’ll explore some of the most common red flags to look out for when evaluating cryptocurrency investment platforms, and how you can protect yourself from falling victim to a scam like Extendedcoins.

1. Unrealistic Promises of High Returns

One of the biggest red flags in any investment opportunity is the promise of guaranteed high returns. While it’s not uncommon for investment platforms to offer returns, promises of returns that seem too good to be true — such as 10%, 14%, or even 30% per day — should immediately raise suspicion. In the world of legitimate investments, high returns come with high risks, and no reputable platform can guarantee such consistent profits.

Scammers use these inflated promises to entice people into investing large sums of money. Once the money is deposited, it may be difficult, if not impossible, to withdraw, and the platform may cease operations altogether, leaving investors with significant losses.

2. Lack of Transparency and Regulatory Oversight

A legitimate cryptocurrency platform will typically be transparent about its operations. It will provide clear details about its company registration, location, and, most importantly, its regulatory compliance. It will also offer proof of its legal status, including licenses issued by recognized financial authorities.

However, fraudulent platforms like Extendedcoins often lack transparency. They rarely provide information about who is behind the platform, how they operate, or whether they comply with financial regulations. In many cases, the website may have vague or missing information about its terms and conditions, team, and physical address. Without this crucial information, it’s nearly impossible to verify whether a platform is legitimate or not.

A red flag should be raised if you cannot find official documentation or proof of regulatory approval. Reputable brokers and investment firms are typically regulated by entities such as the Securities and Exchange Commission (SEC) or local financial authorities in the region where they operate.

Conclusion: The Dark Side of Extendedcoins

The negative reviews surrounding Extendedcoins paint a grim picture of a fraudulent broker that preys on investors’ trust and ambition. With promises of high returns and quick profits, it draws people in, only to trap them with hidden fees, withdrawal issues, and a lack of accountability. The platform’s deceptive tactics, coupled with its lack of transparency and unresponsive customer service, have left many victims without recourse and without their invested funds.

If you’ve been affected by Extendedcoins, it’s crucial to act quickly and seek professional help. By working with experienced legal specialists, such as the Stop-Scam law firm, you can explore your options for recovering your lost funds and holding the perpetrators accountable for their actions.

Remember, scammers rely on the hope that you won’t notice the red flags in time. Be vigilant, and always do your research before making any financial decisions.

I was approached by a so-called financial advisor from ExtendedCoins who convinced me to invest. Everything seemed fine until I tried to access my funds. They demanded additional deposits and then disappeared. I reported them to the authorities, but I’m not sure if anything will come of it. Has anyone had success in similar situations?

Leave a request and our specialists will help you.

ExtendedCoins seemed like a reputable broker at first glance. Their platform was user-friendly, and their customer service was responsive. However, when I tried to withdraw my funds, they became evasive and eventually stopped responding altogether. I’m now seeking legal assistance to recover my investment.

We will be happy to help you, leave a request on the website.

I invested with ExtendedCoins based on a friend’s recommendation. Initially, I saw some returns, but when I tried to withdraw, they claimed I needed to pay a fee. After paying, they asked for more money. I realized too late that it was a scam. I’m sharing my experience to warn others.

Leave a request and we will help you.

I was scammed by ExtendedCoins and lost a significant amount of money. I reached out to a legal firm specializing in financial fraud, and they are currently assisting me in the recovery process. It’s a long and stressful journey, but I remain hopeful.

Specialists will contact you after you leave a request on the website.

ExtendedCoins promised me high returns with minimal risk. I invested, and everything seemed fine until I tried to withdraw my funds. They demanded additional payments and then disappeared. I’ve reported them to the financial authorities and am seeking legal advice.

Our team will help you get your stolen money back, leave a request.