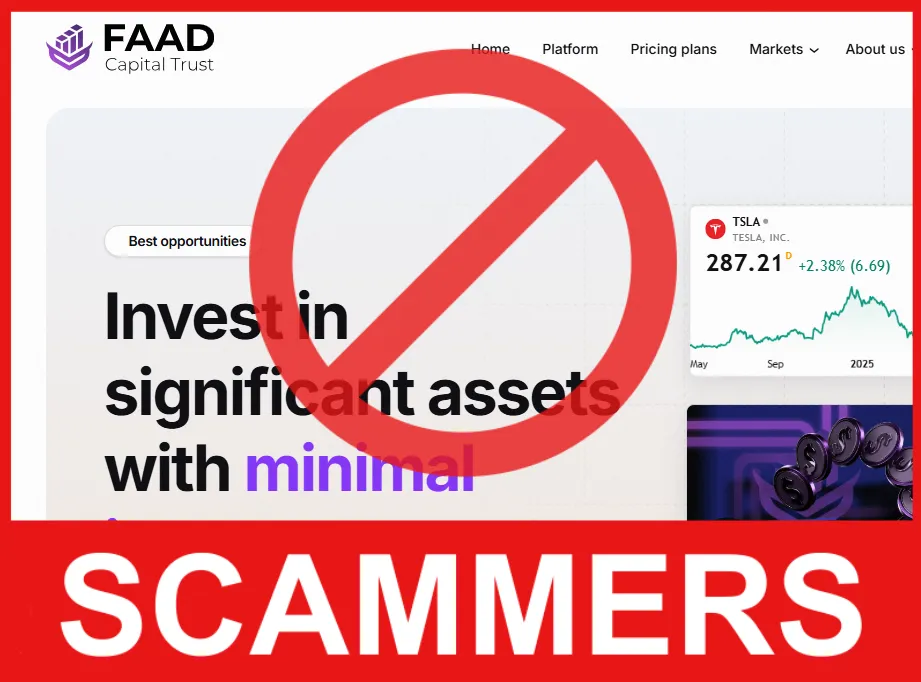

In the vast and often opaque world of online trading, FAAD Capital Trust presents itself as a gateway to lucrative investments across global markets. With promises of high returns, advanced trading platforms, and personalized account management, it seeks to attract both novice and seasoned investors. However, beneath this polished facade lie numerous red flags that suggest potential fraudulent activities. This comprehensive review aims to dissect the operations of FAAD Capital Trust, shedding light on its practices and providing guidance for those who may have fallen victim to its schemes.

Broker Overview: The Allure of FAAD Capital Trust

FAAD Capital Trust’s website showcases a range of trading services, including access to over 500 assets spanning stocks, indices, commodities, and forex. The platform boasts features like AI WebTrader integration, high leverage options up to 1:200, and tiered account plans ranging from a $250 Starter account to a $40,000 VIP account. Each tier offers increasing benefits, such as personal account managers and welcome bonuses of up to 30%.

The site emphasizes security and transparency, claiming to implement advanced technologies and risk management strategies to protect client assets. It also highlights 24/7 customer support and a user-friendly interface designed for both desktop and mobile users.

However, despite these appealing features, several aspects of FAAD Capital Trust’s presentation warrant scrutiny:

- Lack of Transparency: The website provides minimal information about the company’s history, leadership, or regulatory compliance.

- Unrealistic Promises: High leverage options and substantial welcome bonuses are often used as bait by fraudulent brokers to lure unsuspecting investors.

- Generic Content: The site’s content is filled with generic statements and lacks specific details that would typically be present in a legitimate financial institution’s online presence.

Company Verification: Scrutinizing the Legitimacy

A critical step in assessing any financial entity is verifying its registration and regulatory status. FAAD Capital Trust claims to be associated with FAAD Capital Partners, which, according to IFN Investor, secured a license from the Saudi Capital Market Authority in July 2024 . However, this association raises questions:

- Geographical Discrepancies: FAAD Capital Trust lists its legal address in New Delhi, India, while FAAD Capital Partners operates in Saudi Arabia.

- Different Operational Scopes: FAAD Capital Partners is licensed to manage investments and operate funds, whereas FAAD Capital Trust offers retail trading services, a distinction that may not fall under the same regulatory purview.

- Lack of Direct Evidence: There is no verifiable evidence linking FAAD Capital Trust to the licensed FAAD Capital Partners.

Furthermore, a search for FAAD Capital Trust in major financial regulatory databases, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Board of India (SEBI), yields no results, indicating that the broker may be operating without proper authorization.

Exposing Fraudulent Practices: Red Flags and Warning Signs

Several indicators suggest that FAAD Capital Trust may be engaging in fraudulent activities:

- Clone Firm Tactics: The broker’s name and branding bear similarities to legitimate financial institutions, a common tactic used by clone firms to deceive investors. For instance, the FCA has issued warnings about firms impersonating authorized entities to lend credibility to their scams .

- Advance Fee Schemes: Reports from the Financial Services Commission of Ontario highlight cases where entities with similar naming conventions requested upfront fees with promises of substantial returns, only to disappear once funds were transferred .

- Unrealistic Returns: Promises of high returns with minimal risk are characteristic of Ponzi or pyramid schemes. Legitimate investment opportunities always carry some level of risk, and guarantees of consistent profits should be viewed with skepticism.

- Pressure Tactics: Scammers often use high-pressure sales tactics to rush investors into making decisions without adequate research.

Deceptive Schemes: How the Fraud Unfolds

Understanding the modus operandi of fraudulent brokers like FAAD Capital Trust can help potential investors avoid falling prey to such schemes:

- Attractive Offers: The broker advertises high leverage, substantial bonuses, and access to a wide range of assets to entice investors.

- Initial Success: Early investments may show positive returns, encouraging clients to invest more significant amounts.

- Increased Investment: Buoyed by initial gains, investors are persuaded to upgrade their accounts, often requiring substantial additional deposits.

- Withdrawal Issues: When attempting to withdraw funds, clients encounter delays, hidden fees, or are told they must meet certain conditions, effectively trapping their money.

- Communication Breakdown: Eventually, the broker becomes unresponsive, and the investor realizes they have been defrauded.

Recovery Pathways: Reclaiming Lost Funds with Stop-Scam

For victims of such fraudulent schemes, all hope is not lost. Stop-Scam is a law firm specializing in assisting individuals recover funds lost to unscrupulous brokers. Their approach includes:

- Case Evaluation: Analyzing the specifics of the fraud to determine the best course of action.

- Legal Action: Initiating proceedings against the fraudulent entity, including filing complaints with relevant regulatory bodies.

- Fund Recovery: Working with financial institutions and payment processors to trace and recover lost funds.

- Ongoing Support: Providing clients with updates and guidance throughout the recovery process.

Engaging with professionals like Stop-Scam increases the likelihood of recovering lost investments and brings fraudulent entities to justice.

Voices of the Victims: Testimonials and Reviews

Numerous individuals have come forward sharing their experiences with brokers employing similar deceptive practices:

- Capital Trust Markets: Victims reported losing significant sums, with one individual stating they were defrauded of over $100,000. The emotional toll was profound, with some expressing feelings of despair and hopelessness .

- Capital Financial Trust: The Financial Services Commission of Ontario highlighted cases where consumers were asked to pay advance fees with promises of large payouts, only to be left empty-handed .

These accounts underscore the devastating impact such scams can have on individuals, both financially and emotionally.

Proactive Measures: Safeguarding Against Investment Scams

To protect oneself from falling victim to fraudulent brokers:

- Verify Credentials: Always check if the broker is registered with relevant financial authorities.

- Be Skeptical of Guarantees: High returns with little to no risk are red flags.

- Avoid Pressure Tactics: Legitimate firms will not rush you into making investment decisions.

- Conduct Thorough Research: Look for reviews, testimonials, and any regulatory warnings about the broker.

- Consult Professionals: Seek advice from financial advisors or legal experts before making significant investments.

Conclusion: Vigilance is Key

FAAD Capital Trust’s operations exhibit multiple characteristics common to fraudulent brokers, including lack of transparency, unrealistic promises, and questionable regulatory status. Investors must exercise due diligence, remain skeptical of too-good-to-be-true offers, and seek professional assistance when necessary. For those who have already fallen victim, organizations like Stop-Scam provide a pathway to potentially recover lost funds and hold fraudulent entities accountable.