In the ever-evolving world of online trading, fraudulent brokers have become increasingly sophisticated, exploiting technological advancements to deceive unsuspecting investors. One such entity is Finovative AI, a broker that presents itself as a cutting-edge trading platform but has raised numerous red flags indicating fraudulent activities. This article aims to expose the deceptive practices of Finovative AI, providing detailed insights into their operations, the nature of their fraud, and guidance on how victims can seek restitution.

Unmasking Finovative AI: A Detailed Overview

Finovative AI positions itself as a premier online trading platform, offering services across forex, cryptocurrencies, commodities, indices, and stocks. Their website, finovative-ai.com, boasts of advanced trading tools, dedicated customer support, and a suite of account types tailored to various investor needs. However, a closer examination reveals a stark contrast between their claims and actual offerings.

Trading Platform Discrepancies

While Finovative AI claims to provide a robust trading platform, reviews indicate that their platform lacks basic functionalities and does not support advanced features expected from legitimate brokers. Unlike industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer customizable indicators, automated trading, and mobile compatibility, Finovative AI’s platform is rudimentary and potentially manipulated to mislead users about their investment performance .

Exorbitant Minimum Deposit Requirements

Finovative AI requires a minimum deposit of $2,000, significantly higher than the industry average, where reputable brokers often allow starting investments as low as $5 to $100. Such high entry barriers are characteristic of fraudulent schemes aiming to extract substantial funds from victims upfront .

Limited and Risky Payment Methods

Despite claiming to support various payment methods, Finovative AI primarily facilitates deposits through cryptocurrencies. This choice is strategic, as cryptocurrency transactions are irreversible and offer a degree of anonymity, making it challenging for victims to trace or recover their funds.

Scrutinizing Company Credentials

A critical aspect of evaluating any broker is verifying their regulatory status and company legitimacy. Finovative AI fails to provide transparent information regarding its licensing and regulatory compliance.

Absence of Regulatory Oversight

There is no evidence that Finovative AI is registered with any recognized financial regulatory authority. Legitimate brokers are typically registered with bodies such as the U.S. Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), or equivalent organizations in other jurisdictions. The lack of such registration is a significant red flag .

Dubious Company Information

The website lacks verifiable company details, such as a physical address, company registration number, or names of key personnel. This opacity is common among fraudulent entities aiming to avoid accountability and legal repercussions.

Exposing the Fraudulent Practices

Finovative AI employs several deceptive tactics to lure investors and extract funds under false pretenses.

Misrepresentation of Services

The broker claims to offer advanced AI-driven trading solutions, promising high returns with minimal risk. However, such guarantees are unrealistic and indicative of fraudulent schemes. No legitimate investment can assure consistent profits without risk .

Manipulative Account Management

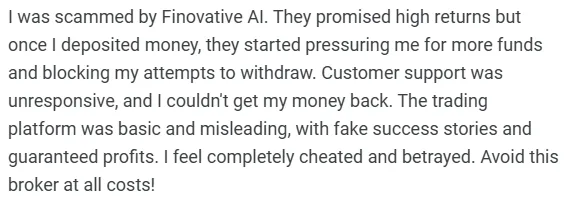

Victims report that after making initial deposits, they are pressured into investing more funds, often under the guise of unlocking better trading conditions or recovering previous losses. Attempts to withdraw funds are met with delays, additional fees, or complete unresponsiveness, effectively trapping investors .

Fabricated Testimonials and Reviews

Finovative AI’s website features positive testimonials and success stories, which are likely fabricated to build credibility. Genuine user reviews on independent platforms paint a contrasting picture, highlighting issues with fund withdrawals and unresponsive customer service .

The Deceptive Scheme: How Finovative AI Operates

Understanding the modus operandi of Finovative AI is crucial for recognizing and avoiding similar scams.

Step 1: Attraction through Promises of High Returns

Finovative AI markets itself aggressively, leveraging the allure of AI-driven trading and high returns to attract investors. They utilize persuasive language and fabricated success stories to build trust and entice individuals to open accounts.

Step 2: Initial Investment and Pressure to Deposit More

Once an account is opened, investors are required to make a substantial initial deposit. Subsequently, they are encouraged to invest more funds to access premium features or recover supposed losses, creating a cycle of continuous investment.

Step 3: Obstruction of Fund Withdrawals

When investors attempt to withdraw their funds, they encounter various obstacles, including unresponsive support, additional fees, or fabricated reasons for denial. This tactic aims to prolong the investment period and extract as much money as possible before the investor realizes the fraud.

Seeking Restitution: How Stop-Scam Can Assist

Victims of Finovative AI’s fraudulent activities are not without recourse. Stop-Scam, a law firm specializing in financial fraud recovery, offers comprehensive services to assist victims in reclaiming their funds.

Expert Legal Assistance

Stop-Scam’s team of legal experts is well-versed in financial regulations and fraud recovery processes. They can navigate the complexities of international financial systems to trace and recover lost funds.

Personalized Case Evaluation

Each case is unique, and Stop-Scam provides personalized evaluations to determine the most effective recovery strategy, considering factors such as the payment method used and the jurisdiction involved.

Liaison with Financial Institutions

Stop-Scam can act as an intermediary between victims and financial institutions, facilitating chargebacks or other recovery mechanisms. Their established relationships with banks and payment processors enhance the likelihood of successful restitution.

Ongoing Support and Guidance

Beyond financial recovery, Stop-Scam offers ongoing support to victims, helping them understand the fraud, prevent future occurrences, and rebuild their financial stability.

Voices of the Victims: Negative Reviews and Testimonials

Numerous victims have shared their experiences with Finovative AI, highlighting the broker’s deceptive practices and the emotional toll of the fraud.

Delayed or Denied Withdrawals

Many investors report difficulties in withdrawing their funds, with requests being ignored or denied without valid reasons. This common issue underscores the broker’s intent to retain investor funds unlawfully.

Unresponsive Customer Support

Victims often encounter unresponsive or evasive customer support when seeking assistance, further complicating efforts to recover funds or obtain information about their investments.

Psychological Manipulation

Some investors describe being subjected to high-pressure tactics and emotional manipulation, such as being told that additional investments are necessary to avoid significant losses or to secure promised returns.

The Broader Context: AI and Investment Fraud

Finovative AI’s fraudulent activities are part of a larger trend where scammers exploit emerging technologies to deceive investors.

The Rise of AI-Driven Scams

Fraudsters increasingly use AI to create convincing fake websites, generate realistic testimonials, and automate deceptive communications. These tools enhance the credibility of scams and make them harder to detect .

Regulatory Warnings

Financial regulatory bodies, including the SEC and FINRA, have issued warnings about unregistered investment platforms claiming to use AI for guaranteed returns. They advise investors to exercise caution and conduct thorough due diligence before engaging with such entities .

Importance of Investor Vigilance

Investors must remain vigilant, critically evaluating investment opportunities, verifying regulatory compliance, and being wary of promises that seem too good to be true.

Conclusion: Protecting Yourself and Seeking Justice

Finovative AI exemplifies the sophisticated tactics employed by fraudulent brokers to exploit investors. By understanding their deceptive practices and recognizing the warning signs, individuals can better protect themselves from such scams.

For those who have fallen victim to Finovative AI, seeking professional assistance is crucial. Stop-Scam offers the expertise and resources necessary to pursue restitution and hold fraudulent entities accountable. Remember, vigilance and informed decision-making are your best defenses against investment fraud.