In today’s increasingly digitalized world, online trading has become a popular avenue for individuals looking to invest and grow their wealth. However, as the popularity of online trading platforms increases, so do the risks of falling prey to fraudulent brokers. One such broker that has been gaining attention for its questionable practices is FLATEX. Despite presenting itself as a legitimate and reputable trading platform, evidence suggests that FLATEX may be involved in fraudulent activities, putting investors’ hard-earned money at significant risk.

This article aims to provide a detailed examination of FLATEX, looking at its operation, the red flags raised by financial authorities, the fraudulent practices it engages in, and how investors who have fallen victim to this platform can work to recover their funds with the help of Stop-Scam specialists. Whether you’re an experienced trader or a newcomer to online investing, understanding the risks associated with FLATEX can help you protect your investments and avoid becoming another victim of their deceptive tactics.

FLATEX: A Broker Under Scrutiny

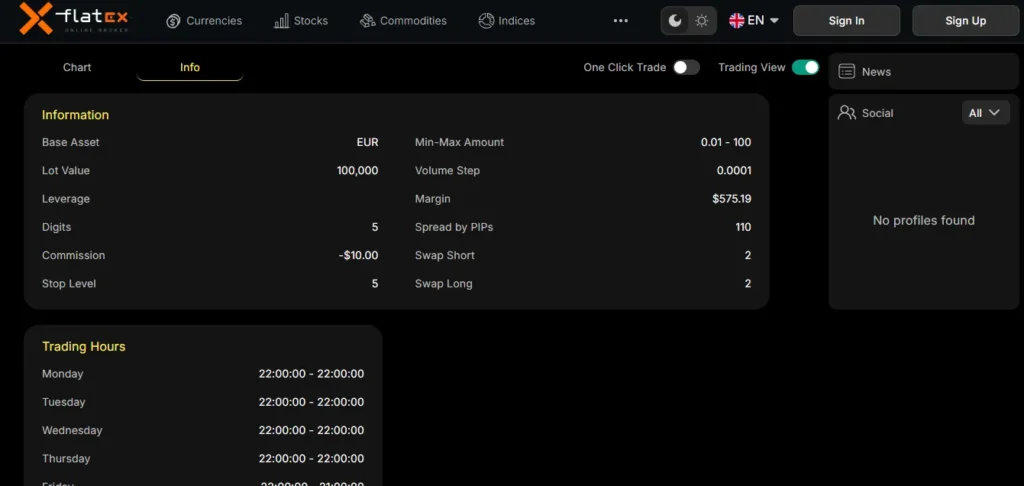

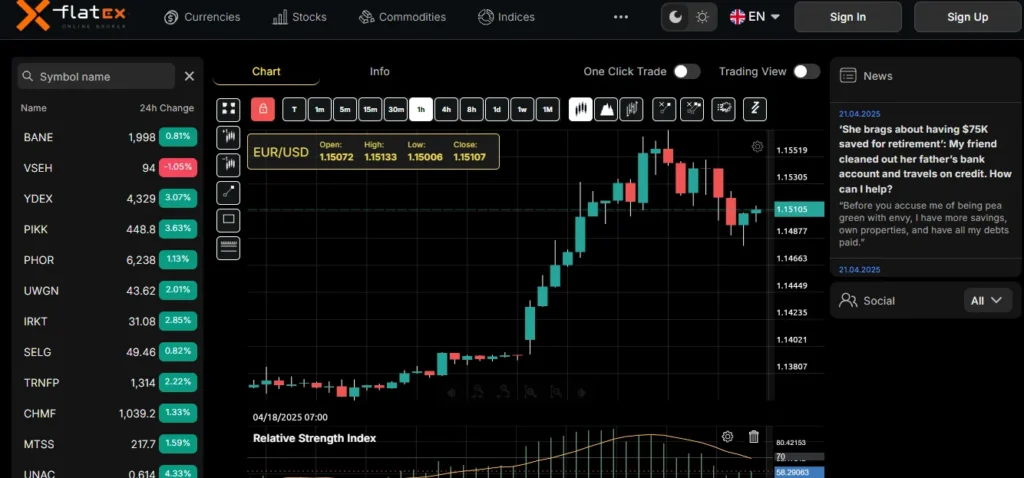

FLATEX positions itself as an online trading platform that offers access to various financial instruments, including forex, stocks, and commodities. It claims to provide its users with advanced trading tools, educational resources, and competitive spreads. However, when looking deeper into FLATEX’s operations, it becomes evident that these promises are nothing more than marketing tactics designed to lure unsuspecting traders.

One of the most glaring red flags about FLATEX is its lack of proper regulation. According to multiple sources, including the UK Financial Conduct Authority (FCA), FLATEX operates without the necessary authorization to provide financial services. In September 2023, the FCA issued a warning against FLATEXTRADES, a brand name under the FLATEX umbrella, stating that it was offering financial services without the required authorization. This is a serious violation of financial regulations and suggests that FLATEX is operating unlawfully, further increasing the risk to investors.

Another issue is FLATEX’s absence from the official registers of reputable financial regulators. While the broker claims to be operating within the regulatory frameworks of various jurisdictions, a closer look reveals that it lacks valid licenses from respected authorities such as the FCA, the Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investments Commission (ASIC). This lack of regulation means that traders have no legal protection in case of disputes or fraudulent activity, leaving them vulnerable to scams.

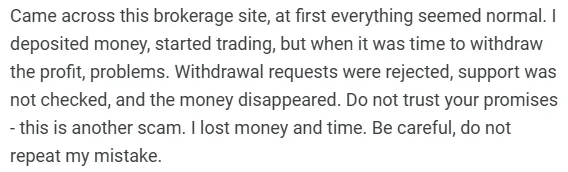

Moreover, several user reviews and third-party websites like WikiFX and TrustPilot have raised concerns about FLATEX’s credibility. Many users have reported problems with withdrawing funds from their accounts, and others have complained about FLATEX’s unresponsiveness to inquiries and requests for assistance. These customer complaints, coupled with the broker’s questionable regulatory status, paint a troubling picture of FLATEX’s operations.

Verification of Company Data: A Web of Deception

A key factor in determining whether a broker is trustworthy is verifying the company’s official data, including its regulatory status, contact information, and the identities of key personnel. Unfortunately, FLATEX fails to meet these basic requirements, which is a strong indication that it may not be operating transparently or in compliance with industry standards.

FLATEX’s websites, including webtrader.flatex.pro, provide limited information about the broker’s legal and corporate status. For instance, there is no detailed information regarding the company’s physical address or the identities of its executives. This lack of transparency is a significant red flag, as legitimate brokers are typically required to disclose this information to ensure accountability and build trust with their clients.

Even more concerning is the fact that FLATEX’s contact details seem deliberately vague. The broker provides a generic email address and phone number, which raises questions about its legitimacy. Reputable brokers usually offer multiple ways for clients to contact them, including dedicated customer support teams, online chat features, and verified phone numbers. The absence of such basic contact details suggests that FLATEX is deliberately trying to avoid accountability.

In addition, attempts to verify FLATEX’s regulatory status have proven to be unsuccessful. While FLATEX claims to be licensed in various jurisdictions, such as the European Union and the UK, independent sources have found no evidence to support these claims. The FCA’s warning, along with the lack of any verifiable licenses or registration numbers, points to the likelihood that FLATEX is operating without proper oversight. This lack of regulation further emphasizes the risks involved in trading with this broker, as it leaves clients with no legal recourse in the event of fraud or dispute.

Exposing FLATEX: Indicators of Fraudulent Activity

Several key indicators suggest that FLATEX is engaged in fraudulent activities. These warning signs, which include its lack of regulation, questionable business practices, and numerous client complaints, all point to the likelihood that FLATEX is running a scam operation. Here are the primary red flags that investors should be aware of:

- Lack of Regulation: One of the most glaring signs that FLATEX is operating as a fraudulent broker is its lack of regulation. As previously mentioned, FLATEX has no valid licenses from major financial regulators, such as the FCA or ASIC. This lack of oversight means that FLATEX can operate without being held accountable for its actions, making it a high-risk platform for traders.

- Unverifiable Company Information: FLATEX fails to provide clear and verifiable information about its legal entity, address, or key executives. Legitimate brokers typically offer full transparency in this regard to build trust with their clients. FLATEX’s refusal to provide such details suggests a deliberate attempt to avoid scrutiny.

- Unresponsive Customer Service: A common complaint from FLATEX’s users is the unresponsiveness of its customer support team. Many investors have reported that they were unable to reach FLATEX’s support staff when they encountered issues with their accounts, such as difficulties withdrawing funds or technical problems on the platform. This lack of support is a classic sign of a fraudulent broker, as it indicates that the company is not genuinely interested in resolving client issues.

- Withdrawal Issues: One of the most common tactics used by fraudulent brokers is obstructing withdrawals to prevent clients from accessing their funds. Several FLATEX clients have reported problems when trying to withdraw their money, with some claiming that their requests were ignored or delayed for weeks, or even months. This is a clear indication that FLATEX may be operating with the intention of withholding investors’ funds.

FLATEX’s Deceptive Scheme: How Investors Are Misled

FLATEX employs a range of deceptive tactics to attract new investors and deceive them into depositing large sums of money. Here’s a closer look at how FLATEX misleads its users and perpetuates its fraudulent scheme:

- Aggressive Marketing: FLATEX uses aggressive online advertising strategies to target potential clients. These ads often promise high returns with minimal risk, which is a classic red flag in the financial industry. They lure in novice investors who may be unfamiliar with the risks of trading, only to later reveal that the platform’s promises were unrealistic and unsubstantiated.

- Misleading Claims of High Returns: FLATEX often advertises “guaranteed” high returns with little to no risk, which is a tactic commonly used by fraudulent brokers. In reality, the world of trading involves substantial risk, and no broker can legitimately promise consistent high returns. By making such claims, FLATEX is attempting to manipulate investors into depositing money without fully understanding the risks involved.

- Obstructed Withdrawals: Once an investor deposits funds with FLATEX, the platform starts to create various obstacles when it comes to withdrawing money. These can include long processing times, excessive fees, or even complete refusal to release the funds. This tactic is designed to trap clients’ money in the system and make it nearly impossible for them to reclaim their investments.

- Unresponsive Support: When traders encounter issues, FLATEX’s customer support is notoriously unresponsive. Many clients have reported that their emails or phone calls went unanswered, and their attempts to resolve issues were met with delays or outright silence. This lack of support is a common sign of a scam broker that is not interested in resolving client disputes.

Recovering Funds from FLATEX: The Role of Stop-Scam Specialists

For investors who have fallen victim to FLATEX’s fraudulent activities, the road to recovery may seem daunting. However, there is hope through organizations like Stop-Scam, which specialize in helping clients recover their lost funds from unscrupulous brokers.

Stop-Scam employs a team of legal experts and financial professionals who are well-versed in dealing with online trading scams. These specialists can assist in identifying fraudulent transactions, contacting the financial institutions involved, and pursuing legal action to recover stolen funds. Additionally, Stop-Scam provides valuable advice on how to file complaints with regulatory authorities and navigate the legal processes involved in recovering lost investments.

By working with Stop-Scam, victims of FLATEX can increase their chances of recovering their money and holding the broker accountable for its actions. However, it is important to act quickly, as there are often time-sensitive deadlines for filing claims and pursuing legal action.

Client Testimonials: Voices of the Affected

The experiences of FLATEX’s clients provide a sobering insight into the dangers of trading with an unregulated broker. Many investors have shared their horror stories online, recounting how they were misled by FLATEX’s promises and left stranded when they attempted to withdraw their funds. Some of the most common complaints include:

- Delayed withdrawals that stretched into months, causing significant financial hardship for clients.

- Unresponsive customer service, with many traders reporting that they were unable to get in touch with anyone at FLATEX to resolve their issues.

- Claims of fraudulent account activity, with some users alleging that FLATEX manipulated their accounts or trades to cause them to lose money.

These testimonials serve as a warning to anyone considering trading with FLATEX, highlighting the risks associated with investing in unregulated and opaque platforms.

Protecting Yourself from Online Trading Scams

To avoid falling victim to scams like FLATEX, investors should take a number of precautionary steps when choosing an online trading platform:

- Research the Broker: Always verify the broker’s regulatory status by checking with official financial authorities. If a broker is not licensed by a reputable regulator, it is best to avoid them altogether.

- Watch for Unrealistic Promises: If a broker promises guaranteed returns with little to no risk, be cautious. Legitimate brokers will never make such claims, as all investments carry inherent risks.

- Use Secure Platforms: Choose brokers that offer secure and transparent trading platforms, with a track record of satisfied clients and a commitment to customer service.

- Consult with Professionals: Before making large investments, consider consulting with a financial advisor or legal expert to ensure that you are making informed decisions.

Conclusion: Vigilance and Professional Assistance Are Key

FLATEX’s deceptive practices, including its lack of regulation, false promises, and obstructed withdrawals, point to its involvement in fraudulent activities. Investors who have fallen victim to this broker are urged to seek professional assistance from organizations like Stop-Scam, which specialize in recovering funds from unscrupulous brokers. By remaining vigilant and taking the necessary precautions, investors can better protect themselves from falling victim to scams like FLATEX.

Thank you for publishing this investigation. I was a victim of Flatex back in 2023 and lost a significant amount of money. At the time, I felt helpless and embarrassed. I started a recovery process last year, and it took months of documentation and communication, but I did manage to recover about 60% of my funds. It’s not everything, but it’s better than nothing. My advice to others is to act quickly and never give up.

Leave a request and our specialists will help you.

Flatex is definitely a scam. They used very professional-looking websites and fake testimonials to build trust. I trusted their platform because they claimed to be regulated in Europe, which turned out to be false. I’m now looking for help to recover what I lost. I’m already working with a law firm, but it’s been a slow process. Does anyone know how long these things usually take?

We will be happy to help you, leave a request on the website.

I was lured in by a social media ad promoting Flatex as a high-tech investment solution. After several weeks of investing small amounts and seeing returns, they convinced me to deposit a much larger sum. That’s when the trouble started. Suddenly, I couldn’t access my funds, and my “account manager” disappeared. I’ve filed a report with my bank and opened a fraud case. I’m hoping some legal action can help, but it’s looking difficult.

Leave a request and we will help you.

I’ve seen a lot of reviews warning about Flatex lately, and I wish I’d come across them sooner. I was scammed for over $8,000. Every time I tried to withdraw my funds, they demanded more fees or taxes that didn’t make any sense. At first, I thought it was part of the process, but now I know better. Has anyone here dealt with a recovery service that specializes in crypto or forex scams?

Specialists will contact you after you leave a request on the website.

These scammers know exactly how to manipulate people. Flatex promised fast profits and showed fake trading activity to make it all seem real. When I asked for a withdrawal, they delayed it again and again until they stopped responding altogether. I’m now trying to get legal advice and recover my funds through a chargeback. If you’re reading this and still have money with them—get out now and report them immediately.

Our team will help you get your stolen money back, leave a request.