In the vast landscape of online trading and investing, finding trustworthy brokers can be akin to navigating a minefield. Unfortunately, amidst the legitimate businesses, there exist nefarious entities like Cana Capital 24, preying on unsuspecting investors. This article serves as a comprehensive exposé on the fraudulent practices of Cana Capital 24, shedding light on their deceitful operations and warning investors to steer clear of their traps.

Information about the Fraudulent Broker: Cana Capital 24 Review

Cana Capital 24 presents itself as a legitimate online trading platform, but a closer examination reveals a different truth. As per the investigation conducted, it is evident that Cana Capital 24 operates without any oversight from a regulatory agency. This lack of regulatory supervision is a glaring red flag, signaling potential danger for investors. Furthermore, the association of Cana Capital 24 with websites promoting “Automated trading software” adds another layer of suspicion, as such platforms are often linked with fraudulent activities.

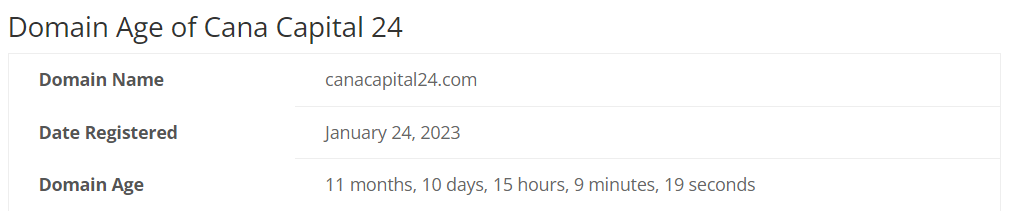

Upon analyzing their website, it becomes apparent that Cana Capital 24 provides no address for their physical location, raising doubts about their credibility and transparency. The domain age of canacapital24.com is relatively young, registered on January 24, 2023, which adds to the skepticism surrounding their legitimacy. Moreover, negative reviews and scam reports have surfaced, indicating a growing dissatisfaction among customers and hinting at the possibility of fraudulent practices.

Verification of Company Data: Uncovering the Truth

When it comes to verifying the legitimacy of Cana Capital 24, the available data paints a concerning picture. The absence of official oversight from regulatory agencies is a major cause for concern, leaving investors vulnerable to potential scams. Despite claims of providing trading services, Cana Capital 24 fails to provide concrete evidence of their legitimacy, with no verifiable address or regulatory certifications.

Moreover, the lack of transparency regarding their physical location and domain age further erodes trust in their credibility. While the website is operational, the absence of concrete company information raises suspicions about the reliability of Cana Capital 24 as a trading platform. Investors are urged to exercise caution and conduct thorough due diligence before engaging with such unregulated brokers.

Exposing the Broker as a Fraudster: Red Flags and Warning Signs

Multiple red flags emerge upon scrutinizing Cana Capital 24’s operations, signaling their dubious intentions. The absence of appropriate regulation and licensing raises questions about their legitimacy and commitment to client asset safety. Unscrupulous brokers often operate in the shadows, evading regulatory scrutiny and exploiting unsuspecting investors for personal gain.

Furthermore, the proliferation of negative reviews and scam reports underscores the fraudulent nature of Cana Capital 24. Investors must heed these warning signs and refrain from entrusting their funds to unregulated and unregistered brokers like Cana Capital 24. Safeguarding one’s wealth requires diligent research and a discerning eye to identify potential scams and protect against financial losses.

Fraud Broker’s Deception Scheme: How Cana Capital 24 Operates

Cana Capital 24 employs various deceptive tactics to lure in unsuspecting investors and defraud them of their hard-earned money. By operating without regulatory oversight, they evade accountability and exploit loopholes to engage in fraudulent schemes. The association with websites promoting “Automated trading software” serves as a smokescreen to attract investors, promising quick and easy profits while concealing the inherent risks.

Their failure to provide verifiable company information, including a physical address and regulatory certifications, is a clear indication of their lack of transparency and legitimacy. Investors who fall victim to Cana Capital 24’s deception are left vulnerable, with little recourse to recover their funds. It is imperative for investors to remain vigilant and conduct thorough due diligence to avoid falling prey to such fraudulent brokers.

In conclusion, Cana Capital 24 exemplifies the dangers lurking in the online trading world, preying on unsuspecting investors with promises of quick riches. However, beneath the facade lies a web of deceit and fraud, leaving investors exposed to significant financial losses. By exposing the deceptive practices of Cana Capital 24 and urging investors to exercise caution, we hope to prevent further exploitation and protect the financial well-being of individuals.

How to Get Money Back from a Scam Broker: A Guide by Stop-Scam Specialists

If you’ve fallen victim to a scam broker like Cana Capital 24, don’t despair. There are steps you can take to reclaim your lost funds, and Stop-Scam specialists are here to help you every step of the way.

Document Everything: The first step in recovering your money is to gather all relevant documents and communications with the broker. This includes emails, account statements, transaction records, and any other evidence of your interactions with Cana Capital 24. The more documentation you have, the stronger your case will be.

Contact Stop-Scam Specialists: Once you have your documentation in order, reach out to Stop-Scam specialists for assistance. They have the expertise and resources to navigate the complex process of recovering funds from fraudulent brokers like Cana Capital 24. They will work tirelessly on your behalf to investigate the matter, gather evidence, and pursue legal action if necessary.

Negotiation and Mediation: Stop-Scam specialists will first attempt to negotiate with the broker to recover your funds amicably. They will leverage their expertise in negotiation and mediation to reach a favorable outcome for you. If the broker refuses to cooperate or negotiate in good faith, Stop-Scam specialists will not hesitate to escalate the matter to legal authorities.

Legal Action: If negotiations fail to yield results, Stop-Scam specialists will take legal action against the scam broker on your behalf. They will file complaints with regulatory agencies, initiate lawsuits, and pursue all available legal remedies to recover your funds. With their extensive experience in dealing with scam brokers, Stop-Scam specialists will fight tirelessly to ensure that you get the justice you deserve.

Follow-Up and Support: Throughout the process, Stop-Scam specialists will provide you with regular updates and support. They will keep you informed of any developments in your case and answer any questions or concerns you may have. You can rest assured knowing that you have a dedicated team of professionals working tirelessly to reclaim your lost funds and hold the scam broker accountable for their actions.

In summary, if you’ve been scammed by a broker like Cana Capital 24, don’t hesitate to seek help from Stop-Scam specialists. With their expertise and dedication, they will guide you through the process of recovering your funds and ensure that justice is served. Remember, you don’t have to face this ordeal alone Stop-Scam specialists are here to help you every step of the way.

Negative Reviews about the Broker: Voices of Affected Clients

The internet is replete with negative reviews and scam reports about Cana Capital 24, echoing the grievances of countless affected clients. These reviews serve as a warning to potential investors, shedding light on the deceitful practices and fraudulent conduct of the broker.

Clients have reported various issues with Cana Capital 24, including difficulty withdrawing funds, unauthorized transactions, and poor customer service. Many have expressed frustration and anger at being deceived by the broker’s promises of easy profits, only to end up losing their hard-earned money.

These negative reviews underscore the importance of due diligence when choosing a broker and highlight the risks of dealing with unregulated and unscrupulous entities like Cana Capital 24. Investors should heed these warnings and exercise caution to avoid falling victim to similar scams in the future.

Beware of False Promises: The Truth About Automated Trading Software

While automated trading software may seem like a convenient solution for novice investors, it’s essential to exercise caution and skepticism when dealing with such platforms. Many scam brokers, including Cana Capital 24, promote automated trading software as a way to lure in unsuspecting investors with promises of easy profits.

However, automated trading software is not a foolproof solution and carries inherent risks. These platforms often lack transparency and oversight, making them susceptible to manipulation and abuse by unscrupulous brokers. Investors should be wary of any broker that promotes automated trading software as a means to bypass regulatory scrutiny and exploit unsuspecting investors.

Instead of relying on automated trading software, investors should focus on conducting thorough due diligence and research before entrusting their funds to any broker. By staying informed and vigilant, investors can protect themselves from falling victim to scams and ensure the safety of their investments.

The Result: Reclaiming Your Financial Security

In conclusion, if you’ve been defrauded by a scam broker like Cana Capital 24, don’t lose hope. With the help of Stop-Scam specialists, you can reclaim your lost funds and hold the fraudulent broker accountable for their actions. By documenting your case, seeking assistance from Stop-Scam specialists, and staying informed, you can protect yourself from falling victim to similar scams in the future. Remember, your financial security is worth fighting for, and Stop-Scam specialists are here to help you every step of the way.