Have you decided to close your trading account or withdraw your earned funds? And suddenly unexpected problems arise? A fraudulent broker is constantly requesting new documents to confirm the identity, withdrawal requests are rejected for flimsy reasons or simply ignored? What to do in this situation? How to get a broker to return the money? The answer is simple: the special procedure of refund of your money (chargeback).

Speculative trading in the financial markets is a way to earn a main or additional income, which is popular with tens of millions of people around the world. The international foreign exchange market FOREX, binary and “vanilla options”, CFDs offer numerous opportunities for improving prosperity for people of all specialties and social strata. However, a positive balance in the trading terminal or in the personal account is not a guarantee of success – some brokers use fraudulent schemes to pump the trader his money on the wallet . How to recognize a fraudster in time and what to do to withdraw your own funds to the current account

How to recognize a scammer?

A brokerage firm is a legal entity that provides individuals, organizations and companies with access to speculative markets. The broker makes his profit through commissions, however, some dishonest market participants use fraudulent methods to get hold of the trader’s money.

You can recognize a cheater by some characteristic features:

- Phone imposition of own services: a large number of calls may indicate dishonest business practices. A reputable broker with an impeccable reputation will not bother users – customers will come to such a company with their money for their own interest.

- Using a mobile or unidentifiable phone number: all reputable brokers use a unified city number or a free telephone line indicated on the website for communication.

- Promises of high, guaranteed profits from investments: trading on financial markets always involves risks, and no company can guarantee you a utopian return.

- Missing company website or missing legal information/Legal notice: Each broker must have a license, a legal and physical address, as well as registration documents that are publicly available. The absence of this data can be a clear indicator of a scam.

- Lack of contract: services in the field of intermediary activity must be provided on the basis of a contract that specifies the rights and obligations of the parties. Before the trader recharges his trading account, he should carefully read the terms of the contract, sign it online or offline and keep it for all possible conflict situations in the future.

Most often, established brokers with a history and reputation have a high appreciation of their reputation. New companies unknown to most users should be viewed with suspicion.

How to get money back from the broker?

According to the guidelines of the “Chargeback Management Guide for Visa Merchants” and the “Chargeback Guide Mastercard”, the Chargeback service can only be used for payments that:

- have been made with VISA, Mastercard, Maestro or American Express;

- were made by a natural person to the broker’s account;

- not later than 540 days before the start of the refund procedure.

Money transfers made by the trader via fast payment systems, online banking portals of the bank, e-wallets or with the help of cryptocurrencies cannot be refunded. This should be paid special attention when choosing methods for recharging one’s account balance.

How does this work in practice? Here is a simple step-by-step guide for users:

Document the correspondence and conversations:

First of all, it is important to carefully document all correspondence and record all telephone calls with the employees of the brokerage company regarding the withdrawal of funds. Deleted emails should by no means be removed, and telephone conversations can be recorded using a voice recorder built into smartphones or special software. From the computer, tablet, smartphone or laptop, all remote access programs should be removed, since there have been cases when fraudsters with the help of AnyDesk (TeamViewer) deleted all correspondence in order to leave their victims without arguments and evidence in the dispute settlement.

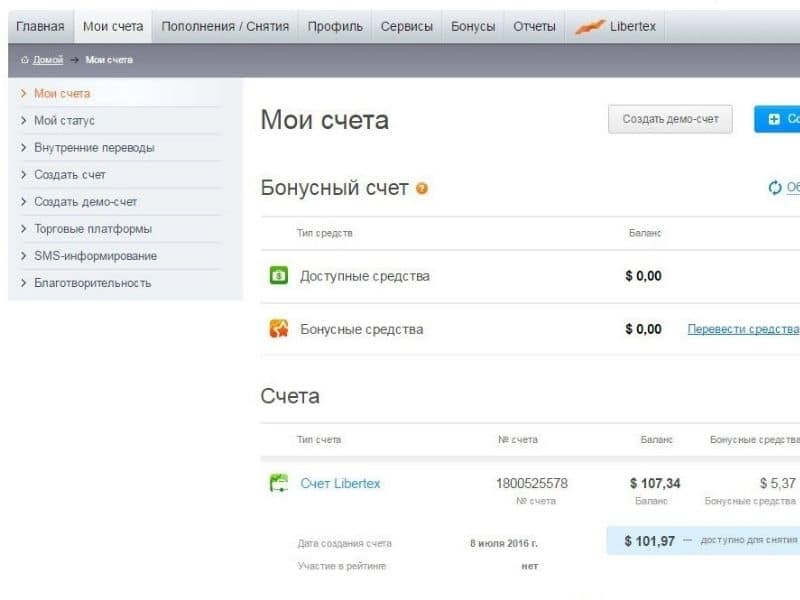

Take screenshots of the account balance: in the user’s personal account, screenshots of all transactions with the broker regarding his trading account should be made:

- Reports on deposits with indication of amounts and dates of credits;

- History of the trading account balance;

- Minutes of requests for withdrawal of funds from the broker.

These screenshots should be made in advance, since many scammers immediately block the trader’s access to the personal account when the first problems with the withdrawal of funds and funds from the broker appear. The most important piece of evidence is the screenshot with the history of deposits: if it is positive at the time of the conflict, then, according to the bank, the trader has the right to withdraw his remaining money in full.

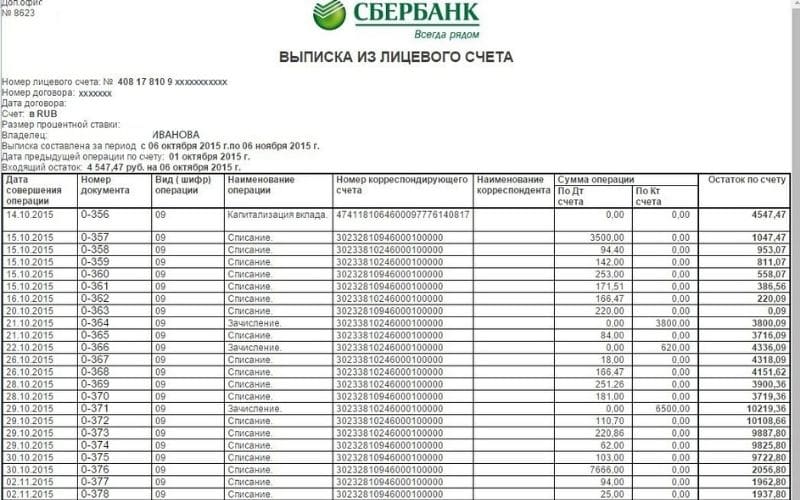

Apply for receipts from the banking institution for the required period: you should apply to the issuing bank for account statements and receipts for payments made to the broker, indicating amounts of money for the required period. The screenshots or downloads of the receipts can be created in the online banking portal of the personal account. If no online services are used, they can be obtained at the bank branch by having a copy certified by a bank consultant and keeping it as a scan copy for shipment.

Think about whether you want to use the chargeback procedure: Before using the chargeback procedure, you should check whether the transactions you want to reclaim meet the necessary conditions, as described above. It is important that the transactions were made with the mentioned cards and the time frame is observed.

Contact your bank: Contact your bank and inform them about the situation. Indicate that you want to use the chargeback service to reclaim the transactions in question. The bank will guide you through the process and provide you with the necessary forms and information that you need to fill out.

Submit all documents and evidence: in order to successfully carry out the chargeback procedure, you must provide all relevant documents and evidence supporting your request. These include the screenshots of the transactions, correspondence with the broker, receipts from the bank and all other relevant documentation. The more comprehensive and convincing your evidence is, the greater the likelihood of a successful outcome.

Work with the bank: during the whole process, you should work closely with your bank and provide all the necessary information or documents on time. The bank will consider the case and make a decision on whether the chargeback request is justified.

Pay attention to possible fees: It is important to be aware that some banks may charge fees for the chargeback procedure. Be sure to find out about any costs before starting the process.

Have patience: the chargeback procedure may take some time, as the bank will have to thoroughly examine the case. Be patient and follow the instructions of your bank.

Summing up, it can be said that the chargeback procedure can be a way to recover money from a fraudulent broker. However, it is important to carefully go through the process, fulfill all the necessary conditions and work closely with your bank. Remember to collect all relevant documents and evidence to support your request.

How to recover money from a broker with a lawyer

The use of a qualified lawyer to recover funds can be justified only if you make a correct request for the return of funds. A lawyer cannot legitimately hold the company (the broker) liable if it is located in another country, as this requires international arbitration. The question of cost plays an important role in this: if you want to get $ 1000 back, it is unlikely that it makes sense to hire a qualified specialist whose work will cost $ 1500. The chargeback process is not particularly complicated technically – any user who has time to collect documents and evidence, fill out the application and monitor the progress of the complaint in various instances can go through it.

Frequently Asked Questions:

You can use the chargeback procedure if a fraudulent broker ignored all requests to withdraw funds, the user’s personal account was blocked, funds were spent without the client’s consent, the broker ignored requests or transactions were made that the traderr did not make.

Most often, the refund is refused if the user filled out the application incorrectly, did not comply with the terms of the contract or did not close open orders.

For the chargeback procedure (refund of funds) from a fraudulent broker, four hundred and forty days are allotted from the moment of the transaction. If this period has expired, the bank will refuse the refund for legitimate reasons.

A lawsuit against a credit organization to recover money from a broker is possible only if the bank delays the processing of the matter or refuses a refund for flimsy reasons. A lawsuit against a fraudulent broker is often useless, since such legal entities are registered in offshore zones and are outside the national jurisdiction. The trial of a case before an international arbitration court requires considerable time and effort.

250

COMPANY

177

OVERVIEW

620

REVIEW